Deep Dive: The Search for Answers in the Commonwealth (r/bostontrees)

Following our initial broad look at the US market, we are zooming in on specific regional hubs. While the Midwest is driving massive volume through deal-hunting, the data from Massachusetts reveals a different story: a mature market that is still asking a lot of questions.

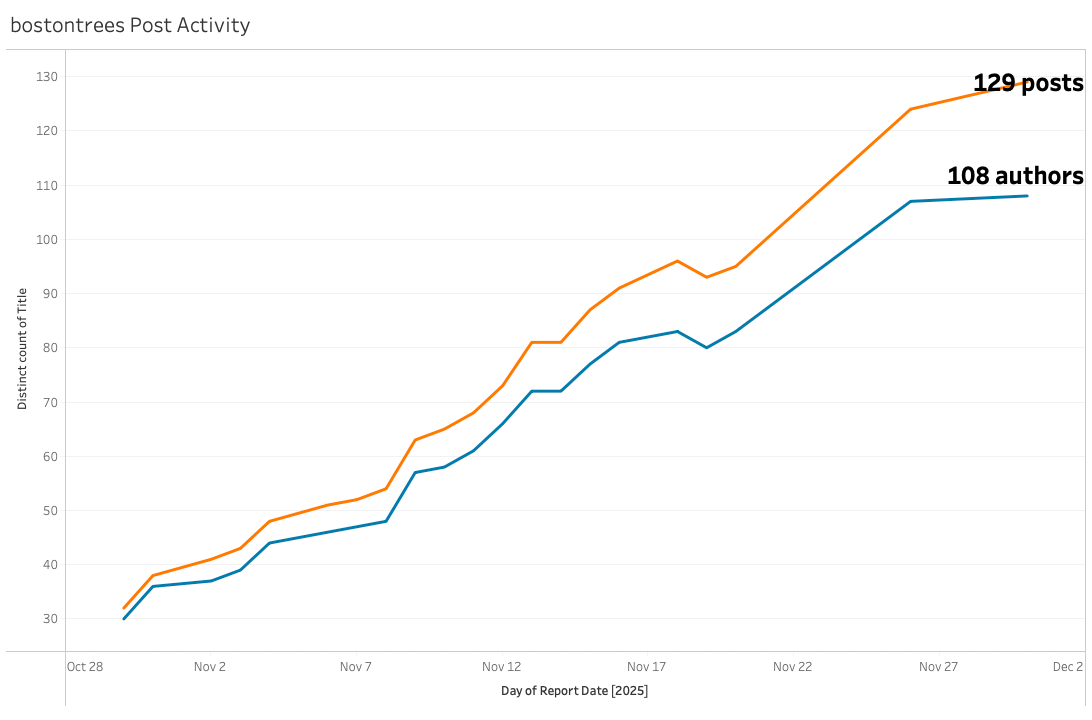

We analyzed the dashboard data for r/bostontrees from October 28 to November 27, 2025. Here is the factual breakdown of the community's activity, growth, and intent, and how it compares to its peers across the country.

Part 1: Activity and Growth — The "Steady" State

Massachusetts is an established legal market, and the subreddit activity reflects a steady, organic rhythm rather than the explosive velocity seen in newer or more volatile regions.

The Numbers (Oct 28 – Nov 27):

- Total Volume: The community generated 129 distinct posts.

- Author Engagement: These posts came from 108 distinct authors.

- Subscriber Momentum: The subreddit grew from 59,566 to 59,848 subscribers, adding 282 new users over the tracked period.

Comparative Analysis:

When we view these numbers against other US hubs, r/bostontrees occupies a distinct "middle ground." It is significantly more active than the restrictive New York medical market but operates at a lower velocity than the "Wild West" markets of the Midwest.

| Subreddit | Distinct Posts | Distinct Authors | Activity Profile |

| r/Michigents | 357 | 218 | High Volume / High Velocity |

| r/ILTrees | 287 | 185 | High Volume / High Velocity |

| r/bostontrees | 129 | 108 | Mid Volume / Steady State |

| r/OKmarijuana | 115 | 89 | Mid Volume / Steady State |

| r/NewYorkMMJ | 68 | 45 | Low Volume / High Engagement |

- Insight: The ratio of Posts to Authors in Boston is nearly 1:1 (1.19). Unlike Michigan (1.6 posts per author), Boston does not rely on a small group of "super users" posting daily hauls. Instead, it relies on unique individuals entering the space, likely to post a single inquiry.

Part 2: Community Intent — The "Help Desk" Archetype

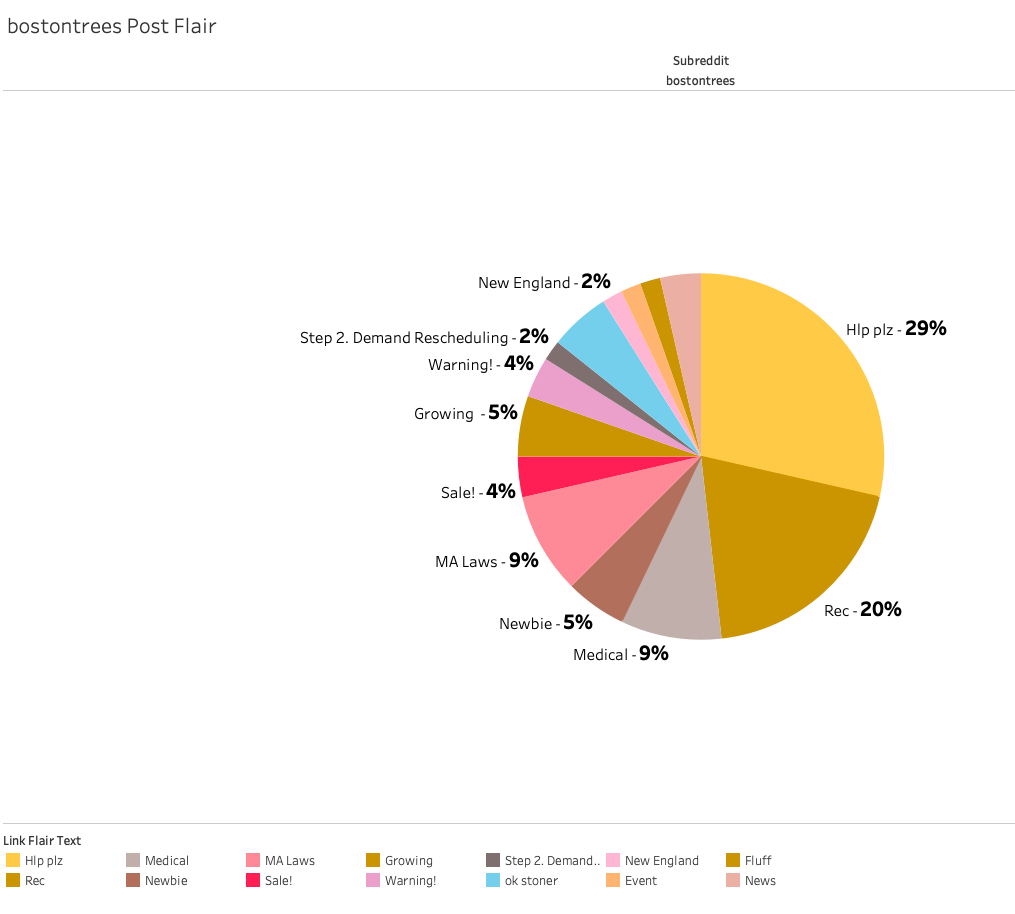

The most revealing metric in our dataset is Post Flair. This tells us why a user is posting. By analyzing the flair distribution, we can assign an "Archetype" to each community.

In r/bostontrees, the data shows a community primarily focused on inquiry and navigation.

The Flair Breakdown:

- "Hlp plz" (29%): The clear dominant category. Nearly 1 in 3 posts is a direct request for assistance.

- "Rec" (20%): Users specifically seeking recreational product recommendations or dispensary locations.

- "Medical" (9%) & "MA Laws" (9%): A combined 18% of the sub is dedicated to patient issues and regulatory discussions.

Comparative Analysis:

When we compare Boston's top flair to other regions, the difference in consumer mindset becomes sharp.

- The Marketplace (Michigan): In

r/Michigents, the top category is "Review" (32%). Users are confident; they are showing off purchases and rating quality. - The Town Hall (New York): In

r/NewYorkMMJ, the top category is "Discussion" (41%). Users are debating the state of the program. - The Help Desk (Boston): With "Hlp plz" and "Rec" combining for nearly 50% of all content, Boston aligns more closely with Illinois (

r/ILTrees), where "Question" (83%) is the dominant flair.

Part 3: The Content Mix

Beyond the raw "Help" stats, the remaining flair data for r/bostontrees highlights a market with specific nuances that brands must understand.

- Low Deal Sensitivity: Only 4% of posts used the "Sales!" flair. Unlike Michigan, where deal-hunting drives the feed, the Boston consumer appears less focused on price drops and more focused on solving problems or finding specific products.

- The Regulatory Eye: The "MA Laws" (9%) flair is a significant outlier. It is rare to see a consumer subreddit dedicate nearly 10% of its volume to legal discussions. This suggests a consumer base that is highly aware of (and potentially frustrated by) the regulatory framework governing their purchases.

- The "Newbie" Presence: 5% of posts are tagged "Newbie," reinforcing the "Help Desk" archetype. New consumers are entering the market and immediately turning to Reddit for guidance.

Why Boston Matters for Bud Trendz

If we only looked at "Review" counts, we might overlook the value of the Boston market. However, the data proves that r/bostontrees is a critical hub for Pre-Purchase Intent.

While Michigan users are telling us what they bought, Boston users are telling us what they need.

For a data tracker like Bud Trendz, high scores in r/bostontrees likely indicate Information Gaps. If a brand or product type is trending here, it is often because consumers are struggling to find it or understand it.

Summary of the Boston Archetype:

- Volume: Moderate & Unique (108 Authors).

- Primary Action: Asking Questions ("Hlp plz" 29%).

- Secondary Action: Navigating Regulations ("MA Laws" 9%).

- Key Opportunity: Education and Guidance.

The Voice of the User: What is Boston Actually Asking?

The "Trend Score" tells us where the attention is going, but the text data tells us why. By analyzing the unique posts within the "Hlp plz" category (29% of all content), we can identify the exact friction points where the Massachusetts market is failing its consumers.

It turns out, Boston consumers aren't just confused—they are often being misled by a complex market.

1. The "Math" Problem: Real vs. Fake Edibles

The Top Query: "50mg vs 500mg? What's the difference?" The Issue: This is a critical finding. Users are expressing deep confusion between regulated dispensary edibles (capped at 5mg/serving) and unregulated "Smoke Shop" gummies (often hemp-derived Delta-9) that advertise massive 500mg+ dosages.

- The User Experience: One user reported feeling "toasted" by a 50mg dispensary drink but feeling "nothing" from a 500mg smoke shop gummy.

- The Insight: The market is flooded with "fake high numbers." Consumers are turning to Reddit because they don't understand why the "weaker" legal product hits harder than the "stronger" gray market product.

2. The Logistics Problem: The Vape Mail Ban

The Recurring Headache: "Shipping to MA? ...It looks like major websites stopped shipping vapes." The Issue: This remains a dominant frustration. Massachusetts' strict PACT Act enforcement means consumers cannot get high-end dry herb vaporizers shipped to their homes.

- The Opportunity: There is a captive audience of consumers who want to switch to healthier consumption methods (vaping flower) but are blocked by logistics. Local retailers who stock premium hardware (like Storz & Bickel) have a massive advantage here.

3. The "Vanishing Product" Problem

The Complaint: "Why is in-stock availability so difficult to find?" The Issue: Users are frustrated by the lack of consistency. They find a topical or flower strain they love, only for it to disappear from shelves forever.

- The Insight: This points to a "churn and burn" product strategy by retailers that is alienating loyal customers. Consumers are asking for stability in a market that prioritizes "New Drops."

4. The "Legacy" Gap: Where is the Old School?

The Niche Hunt: "Looking for oldschool 'Blonde Hash' for my mother's husband." The Issue: Modern concentrates (Rosin/Resin) are too complex for older consumers who want the traditional "cup and straw" hash experience.

- The Opportunity: As the market chases the highest THC% and wildest terpene profiles, a significant demographic (older, wealthier consumers) is being left behind because they can't find simple, traditional hashish or High CBD Flower (another top request).

Summary: The "Help Desk" Opportunity

The data proves that r/bostontrees is a community searching for reliability.

- They want reliable dosing info (Real vs. Fake).

- They want reliable access (Vape shipping).

- They want reliable stock (Products that don't vanish).

For a brand entering Massachusetts, the strategy is clear: Don't just sell "Fire." Sell "Consistency." If you can be the brand that is always in stock, clearly labeled, and easy to find, you will solve the primary headache of the Boston consumer.