September 2025: Canadian Cannabis Brand Sentiment

September 2025 saw Canadian cannabis brand attention remain highly competitive and dynamic across all product types. The top five most-discussed brands were Tenzo, Simply Bare, BLKMKT, 1964, and Woody Nelson. It’s notable that the current top five brands are owned by just three companies: Tenzo and BLKMKT are both under Avant Brands, Simply Bare and 1964 are products of Rubicon Organics, and Woody Nelson remains an independent.

The exact number of unique brands appearing on the September 2025 list is 182. In August, there were 211 unique brands. This means there are 29 fewer brands being discussed in September compared to August. The percent variance in unique brand count from August to September 2025 is approximately -13.7%.

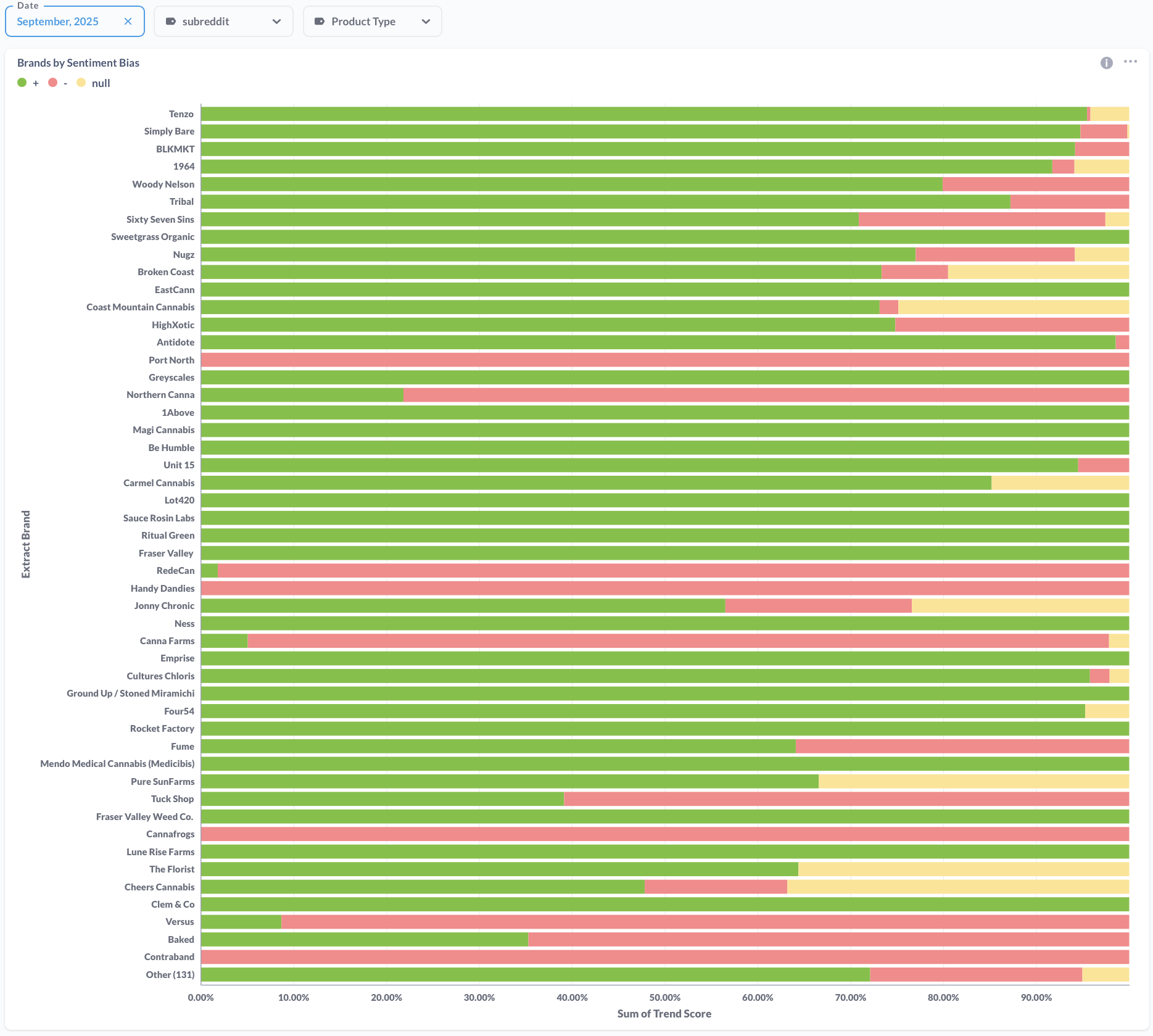

ALL PRODUCT TYPES

Key Shifts and Trends

- Beyond the top five, Tribal remains a significant market mainstay, consistently appearing among Canada’s top brands.

- Sixty Seven Sins, established just over a year ago, has recently faced some notably negative posts, reflecting shifting consumer sentiment.

- Nugz operates as the value brand from Cannara (which also owns Tribal), gaining attention mainly through larger product formats like 14g and half-ounce packages.

- Sweetgrass Organic sells flower both under the Woody Nelson brand and through its own product releases, benefiting from positive attention tied to both.

- Broken Coast is re-emerging as a popular premium brand, though its recent feedback includes a mix of positive and neutral sentiments.

- Port North appears in the top 20 but is notable this month for receiving exclusively negative feedback.

- Greyscales, an emerging brand, stands out for having no negative feedback reported so far.

- Carmel Cannabis, typically a top 10 brand, remains visible with mostly positive and some neutral feedback.

- Fraser Valley, known as a budget brand, received 100% positive sentiment this month.

- RedeCan faces mostly negative feedback for this period.

- Canna Farms has negative feedback this month, with one reviewer noting aged product.

- Baked Cannabis has introduced smaller product sizes this month, which has drawn attention but sentiment details are not elaborated here.

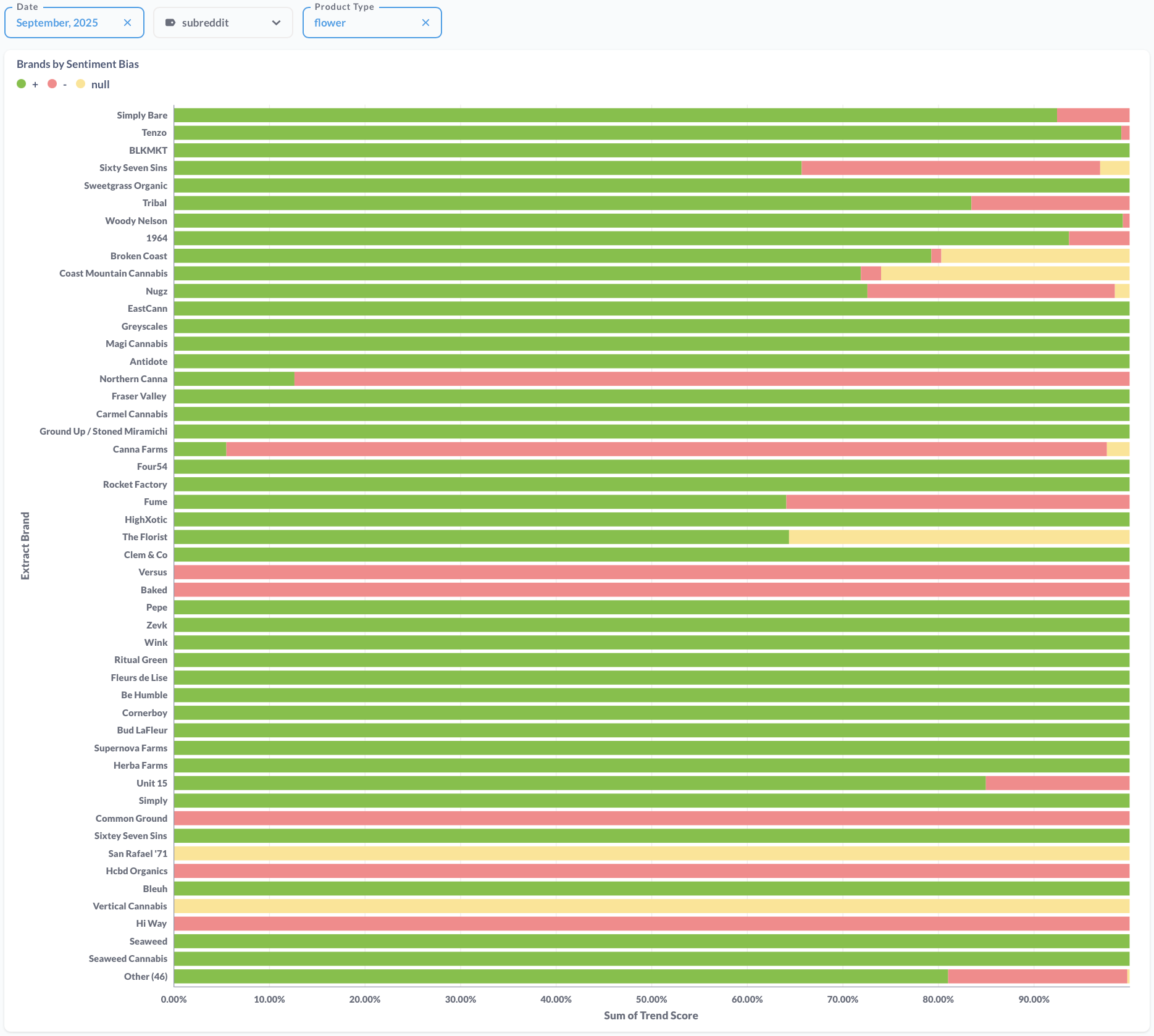

FLOWER

Who’s on Top for Flower

- In September, Simply Bare leads the flower discussion, followed by Tenzo, BLKMKT, Sixty Seven Sins, and Sweetgrass Organic.

- Both Tenzo and BLKMKT (Avant Brands), as well as Simply Bare (Rubicon Organics), hold strong top positions, confirming dominance from these parent companies in the flower segment.

Notably Good and Bad Brands

- Positive sentiment continues to cluster around mainstays like Simply Bare, Tenzo, Sixty Seven Sins, Sweetgrass Organic, and Tribal. These brands maintain high levels of positive feedback from consumers, indicating sustained satisfaction.

- Negative sentiment stands out for brands such as Antidote, Northern Canna, RedeCan, Canna Farms, Baked, and Versus. Brands like Canna Farms show increased negative feedback compared to August, while others such as RedeCan and Antidote also maintain mostly negative sentiment during September.

Month-over-Month Brand Movement

- Simply Bare moved from third position in August to the top spot in September, improving in both attention and sentiment.

- Tenzo gained ground compared to August, rising to the second spot.

- BLKMKT remains among the top three for both months, while Sixty Seven Sins and Sweetgrass Organic continue to perform well.

- Woody Nelson, which held more prominence in August, appears further down in the September order, with a more mixed distribution of sentiment.

- Brands like Broken Coast shifted down the ranks, while Fraser Valley and Greyscales climbed, reflecting substantial improvements in positive feedback.

Changes in Brand Sentiment

- Overall brand sentiment for the top players has tilted more positive in September, with fewer brands showing significant neutral feedback compared to August.

- The dominant negative feedback shifted slightly from major names like BLKMKT and Woody Nelson in August to brands like Northern Canna, Canna Farms, and Baked in September.

- Newly emerging brands, such as The Florist and Greyscales, are attracting largely positive attention, suggesting new consumer interest and favorable first impressions.

Summary Table: Top 5 Flower Brands Sentiment (September)

| Brand | Sentiment Bias |

|---|---|

| Simply Bare | Mostly positive |

| Tenzo | Mostly positive |

| BLKMKT | Mostly positive |

| Sixty Seven Sins | Mostly positive, some negative |

| Sweetgrass Organic | Mostly positive |

September highlighted consolidation at the top and movement among mid-tier brands, as consumer feedback became more polarized for certain players while positive sentiment strengthened for several newcomers and legacy favourites.

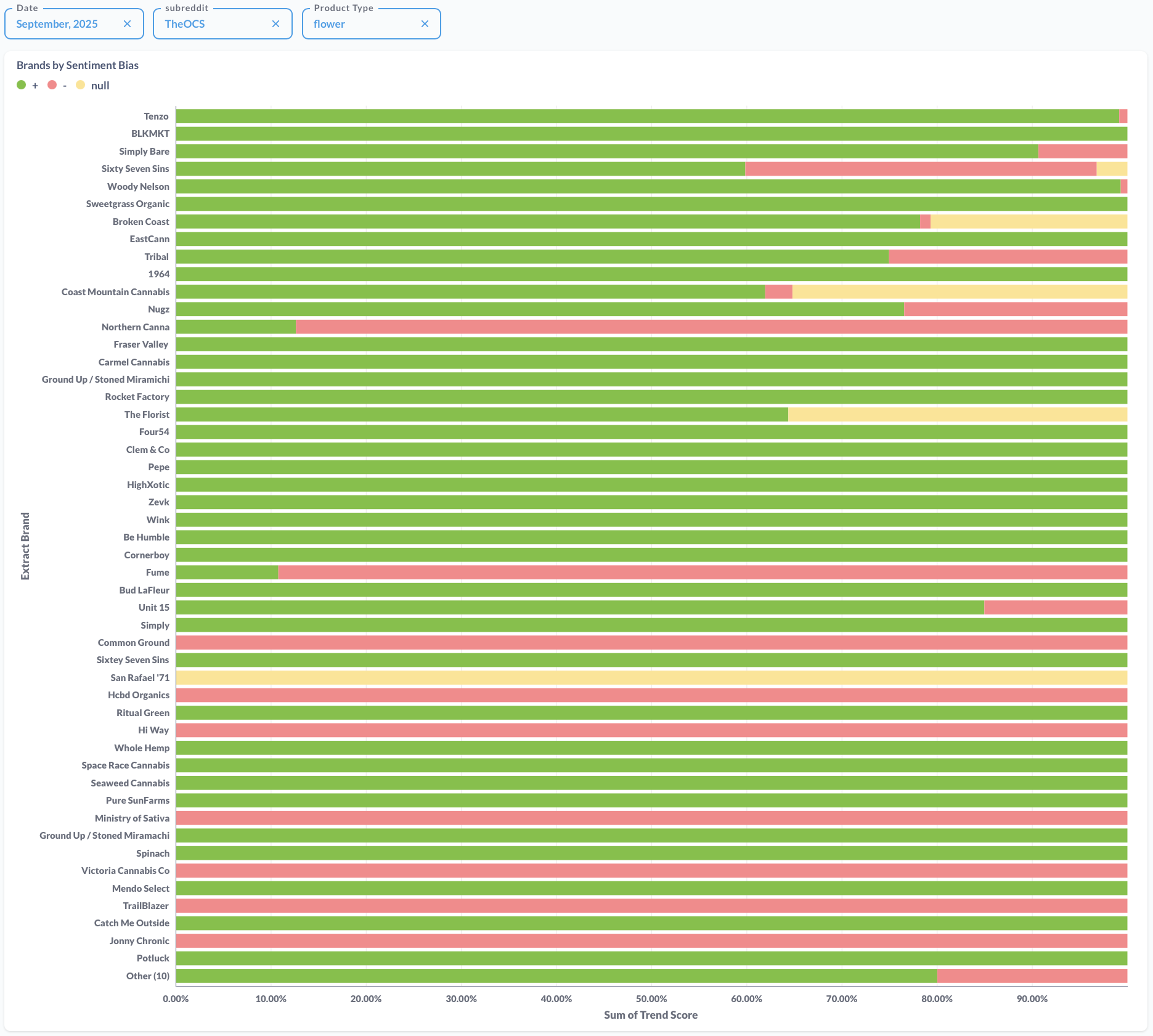

r/THEOCS FLOWER

Let’s drill down one more layer and look at the brands showing up specifically on the OCS flower list. If there’s a “big league” for cannabis reviews in Canada, TheOCS subreddit is it—this is the most negative subreddit tracked, so consistently strong performance here is especially impressive.

September 2025 OCS Flower Brands: Month-over-Month Play-by-Play

- Who’s on Top: Tenzo takes the top spot in September, followed by BLKMKT, Simply Bare, Sixty Seven Sins, and Woody Nelson. These brands show strong positive trend scores, especially impressive given the tough nature of OCS reviews.

- Notably Good: Tenzo, BLKMKT, Simply Bare, Sweetgrass Organic, Tribal, and Broken Coast all have a majority of positive sentiment, continuing their established reputations and strong consumer appeal. For the second month in a row, Tenzo’s sentiment stands out as among the most positive at the head of the list.

- Notably Bad: Brands such as Northern Canna and Fume have prominent negative sentiment in September. Fume, in particular, has almost exclusively negative feedback this month, and Northern Canna holds mostly negative responses as well.

- 100% Feedback Extremes: No brand holds 100% positive sentiment across both months; however, Fraser Valley came very close to full positive feedback in September. Fume achieved nearly 100% negative sentiment in September, a drop from a mix of feedback in August.

- Risers and Fallers: Woody Nelson drops from a higher position in August to further down in September, with sentiment shifting to more negative and neutral. Greyscales moves up the list due to a strong run of positive posts and minimal negatives. Fraser Valley and The Florist rise in visibility with more positive responses. Fume, Northern Canna, and Ritual Green gain more attention for negative reasons.

- Unchanged Leaders: BLKMKT and Simply Bare maintain top-tier status, while Tribal and Sweetgrass Organic remain solid performers month-over-month.

Consistently strong positive sentiment on the OCS subreddit signals robust consumer trust, while surges in negative feedback often point to emerging product quality issues or shifting preferences. Brands rising up the ranks with improved sentiment include Greyscales, Fraser Valley, and The Florist. Those facing a notable downturn in perception are Fume and Northern Canna.

Key Takeaways

September’s sentiment and trend data reinforce that established names like Tenzo, BLKMKT, Simply Bare, and Sixty Seven Sins continue to dominate consumer attention in both overall and flower-specific categories. Parent companies Avant Brands and Rubicon Organics, along with standout independents like Woody Nelson, consistently capture the top spots.

Month-over-month, overall brand counts declined, showing a more competitive selection this round—with several mid-tier and emerging brands either rising or dropping off entirely. On the notoriously tough OCS subreddit, positive performance by Tenzo, BLKMKT, Simply Bare, Sweetgrass Organic, and Tribal is especially notable. Meanwhile, negative sentiment is concentrated around brands such as Fume, Northern Canna, and Canna Farms for September, indicating areas of concern or shifting consumer expectations.

A few brands—Fraser Valley and Greyscales among them—have gained momentum with consistently positive feedback, while others faced sharper criticism or a mix of praise and complaints. The data once again highlights volatile consumer tastes and the immediate consequences of quality or value perceptions.

Explore the Data Yourself

Want to explore the data yourself?

You can filter by subreddit and time period in our Live Brand Sentiment Dashboard here:

Stay tuned for more insights each week as we track the evolving Canadian cannabis landscape through the lens of Reddit’s most engaged consumers.