September 2024 Canadian Cannabis Brands By Sentiment

Introduction

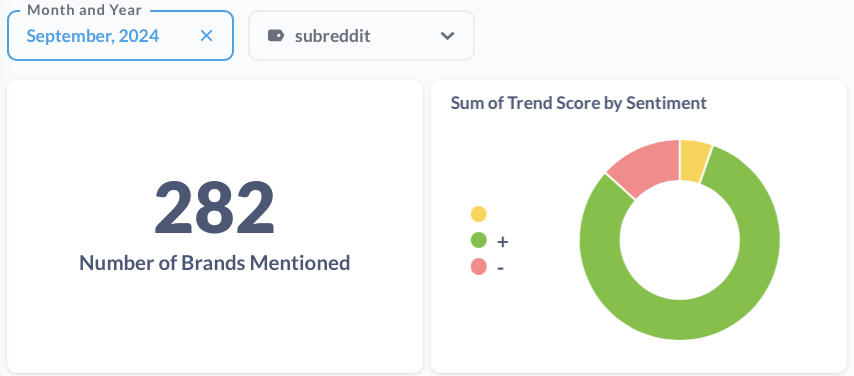

Thanks for joining us as we take a close look at Canadian cannabis brands and their trending performance across six separate Reddit communities. These discussions are organized by brand popularity, specifically in terms of their trend score, which captures the amount of attention each brand received over the past month.

This score includes upvotes, downvotes, and comments, all measured through a decaying algorithm to weigh newer activity more heavily. Sentiment analysis, powered by a large language machine, evaluates whether the attention is positive, negative, or neutral, giving us a clearer picture of how each brand is perceived.

Method

The trend score for each brand is derived by calculating the total interactions—upvotes, downvotes, and comments—on posts mentioning the brand across various Reddit threads. These interactions are weighted by time, meaning newer activity has a higher impact on the score.

To differentiate between positive, negative, and neutral interactions, we use sentiment analysis, which evaluates the tone of the posts. The sentiment score is then broken down into three categories: total trend score (overall attention), positive trend score, and negative trend score.

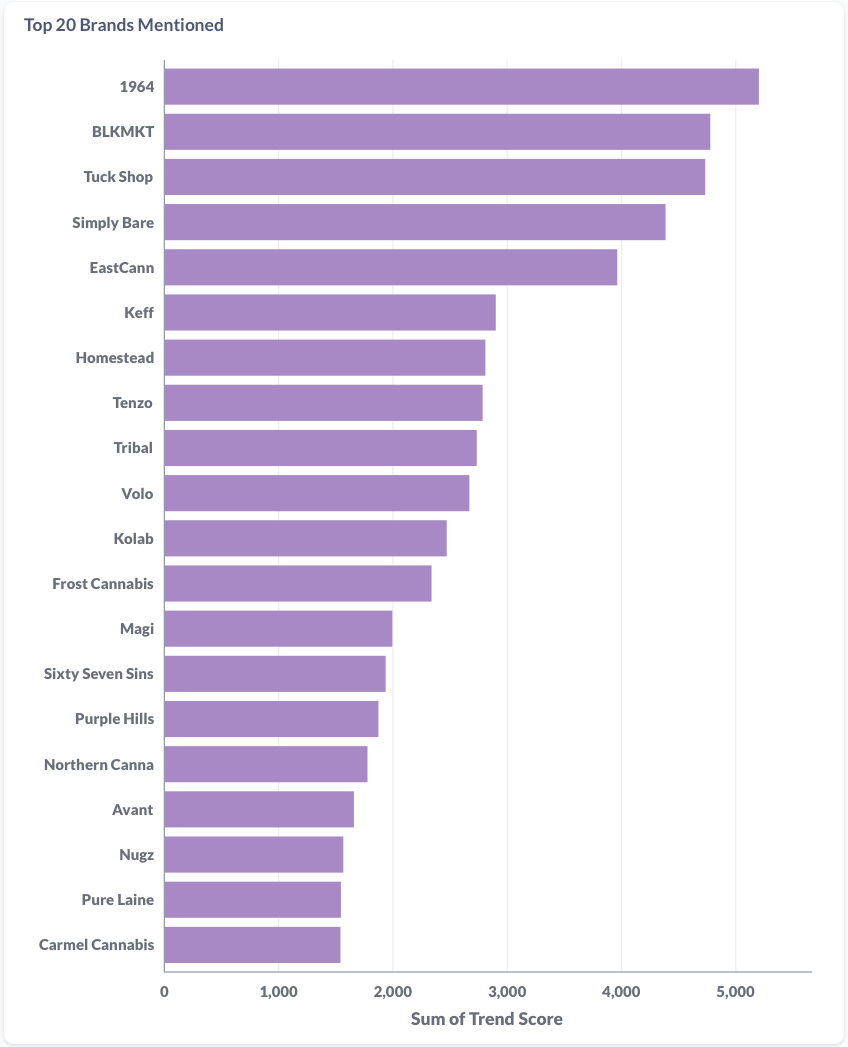

Total Trend Score - Top 5 Brands

For September, the brands with the highest overall trend scores were Tuck Shop, Rubicon Organics' 1964 and Simply Bare, EastCann, and Tenzo. These five brands garnered the most attention across Reddit this month. Tuck Shop led the pack. Rubicon Organics' Simply Bare and 1964 rands were also standout performers.

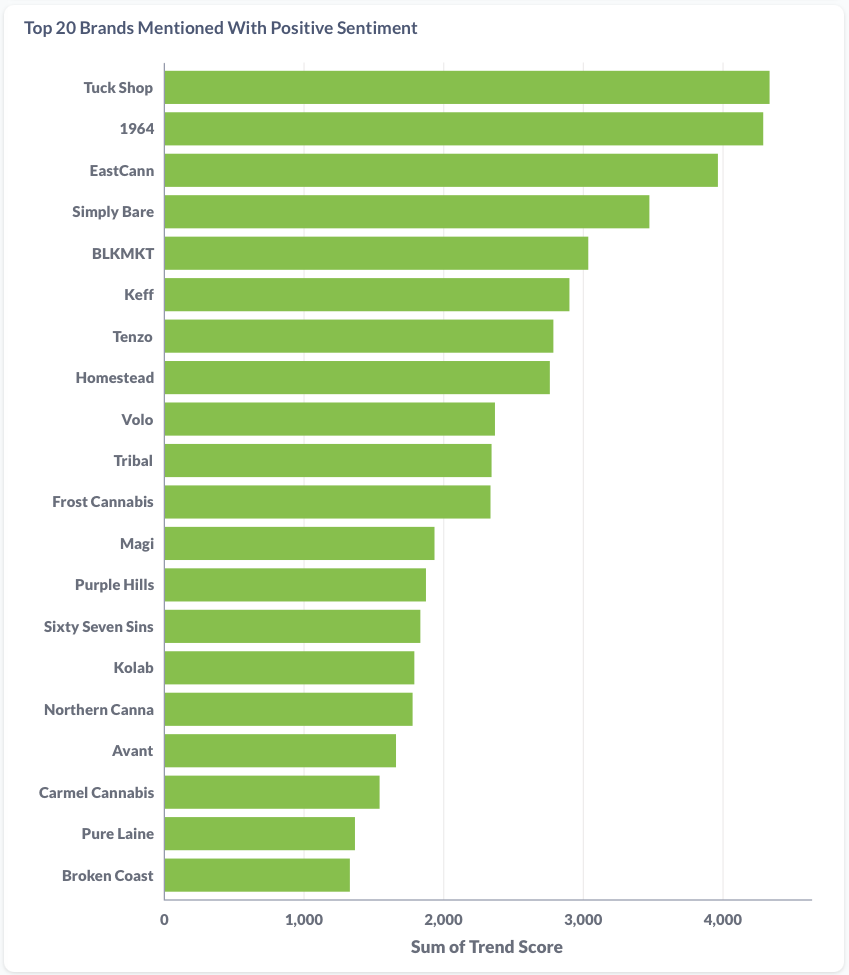

Positive Trend Score - Top Brands

Focusing solely on positive sentiment, Tuck Shop claimed the highest trend score for the month, with 93% of its attention marked as positive.

The second highest positive trend score went to 1964, which received nearly 83% positive sentiment (dipping from 95% positive sentiment last month).

EastCann, with a comparable amount of trend score to the leaders this month, managed to secure 100% of its score from positive mentions.

Simply Bare made a strong showing again this month, with almost 80% of its trend score in the positive column (down from 97% last month).

Rounding out the group, Tenzo claimed the fifth spot, with 100% of its September trend score classified as positive.

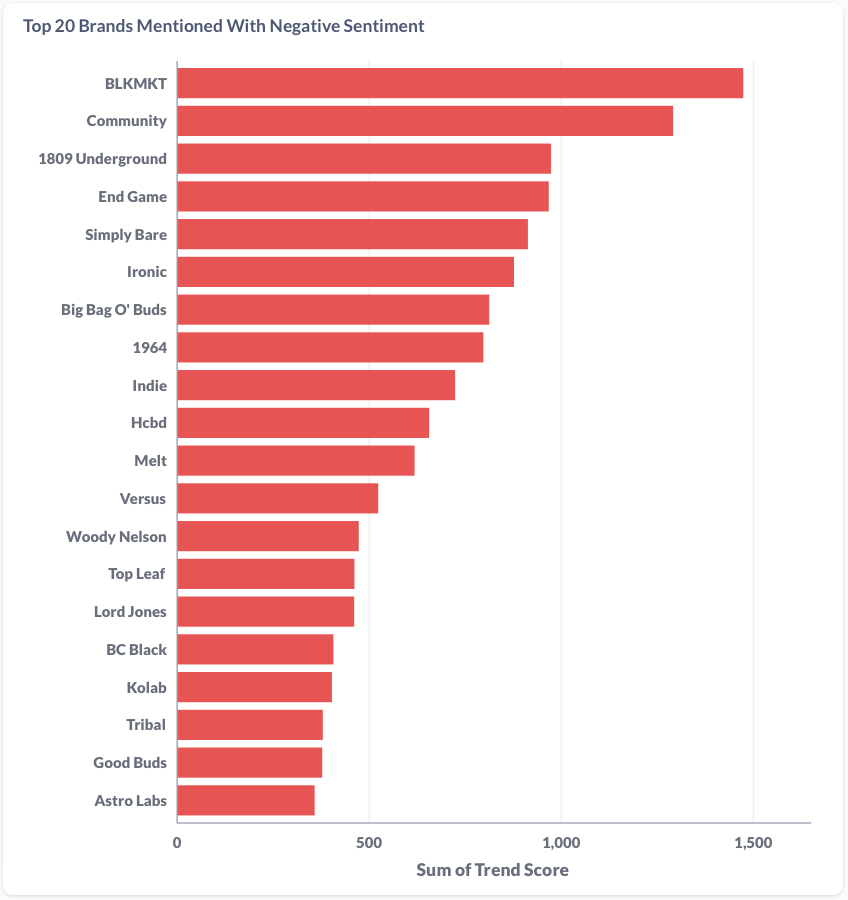

Negative Trend Score - Top Brands

On the other end of the spectrum, BLKMKT earned the most attention for negative sentiment, with 35% of its trend score this month being negative.

Community followed, securing the second spot with a 100% of its trend score being negative.

1809 Underground appeared third on the negative sentiment list, another with 100% of its total trend score for the month being negative.

EndGame also appeared on the negative sentiment list with 100% of trend score in the negative column.

Simply Bare makes another appearance this month. Although they were among the top earners in trend score, over 20% of their mentions were tied to negative posts. This is why they feature on both the negative and positive lists.

Summary

Thanks for reading the brand sentiment summary this month. Tuck Shop led in total trend score, followed by Rubicon Organics' Simply Bare and 1964, EastCann, and Tenzo. In terms of positive sentiment, Tuck Shop also dominated with 93% of its mentions being positive. EastCann and Tenzo received 100% positive sentiment, while Simply Bare saw a slight dip to 80% positive.

In contrast, BLKMKT led in negative sentiment, with 35% of its trend score being negative. Community, 1809 Underground, and EndGame followed, all receiving 100% negative mentions. Simply Bare appeared on both the positive and negative lists, with over 20% of its mentions being negative despite its overall strong performance.

Understanding these shifts in sentiment provides valuable insights for brands and consumers alike, showing how quickly online conversations can influence public perception.

We've made the dataset used in this article available in CSV format for download below. If you’d like more information about our dashboards, the raw data, or how we can assist you, don’t hesitate to reach out.