Q4 2024 Weekly Top 10 Brand Analysis: Tracking Momentum in the Cannabis Community

While our previous posts examined quarterly totals for brand engagement and Trend Scores, this analysis takes a different approach. Every Friday throughout Q4 2024, we captured a snapshot of the week's hottest brands based on their Trend Score performance across our tracked Reddit communities (215,000 subscribers across six subreddits).

These weekly rankings offer unique insights that quarterly aggregates might miss:

- Which brands consistently maintain community interest

- Breakthrough moments for emerging brands

- Impact of new product launches

- Weekly competitive dynamics

- Seasonal trends and patterns

Think of this as a week-by-week replay of Q4, showing which brands generated the most buzz heading into each weekend. Rather than reproducing our weekly "What's Hot" posts in full, we'll focus on identifying patterns in brand performance and highlighting notable movements within the top 10 rankings.

Let's dive into the weekly data and see which brands showed staying power and which ones had their moment in the spotlight...

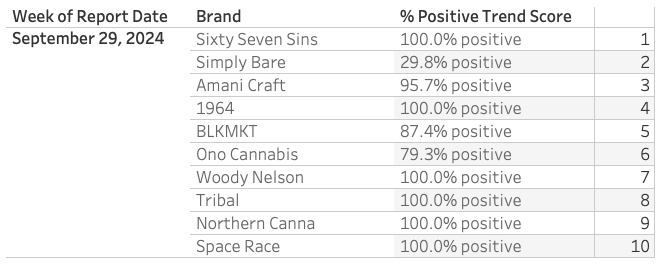

Starting our weekly analysis with September 29, 2024:

The final week of September saw Sixty Seven Sins claim the top spot, setting the stage for what we'll later see was a strong Q4 performance (as shown in our previous trend score analysis). Simply Bare secured second place, while Amani Craft made an impressive debut at #3.

1964, which we know becomes a consistent performer through Q4, landed at #4, with BLKMKT rounding out the top 5. Ono Cannabis, despite being classified in our emerging brands category, managed to secure the #6 position. Woody Nelson and Tribal, both powerhouses in our overall Q4 analysis, appeared at #7 and #8 respectively. Northern Canna took #9, while Space Race closed out the top 10.

This week serves as our baseline for tracking movement in subsequent weeks. We'll pay particular attention to whether brands like Sixty Seven Sins can maintain their momentum, and if emerging players like Ono Cannabis can consistently compete with the established Top Tier brands.

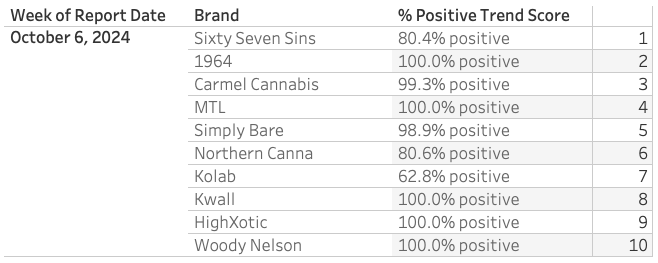

Week of October 6, 2024:

Sixty Seven Sins maintained its #1 position for a second consecutive week, though with a notably specific 80.4% positive sentiment. 1964 made a strong move from #4 to #2, achieving a perfect 100% positive rating. Carmel Cannabis made its first appearance in our top 10, debuting impressively at #3 with a near-perfect 99.3% sentiment.

MTL and Simply Bare (dropping from #2 to #5) both showed strong positive sentiment, with MTL achieving 100% positive reviews in its first appearance. Northern Canna held onto a top 10 position, sliding from #9 to #6, while maintaining a solid 80.6% positive rating.

New entries this week included:

- Kolab at #7 (62.8% positive - the lowest sentiment in this week's top 10)

- Kwall at #8 (perfect 100% sentiment)

- HighXotic at #9 (another perfect score)

- Woody Nelson slipped to #10 from #7 last week, despite 100% positive reviews

Notable exits from last week's top 10:

- Amani Craft (previously #3)

- BLKMKT (previously #5)

- Ono Cannabis (previously #6)

- Tribal (previously #8)

- Space Race (previously #10)

This week showed remarkably high sentiment scores, with five brands achieving 100% positive reviews.

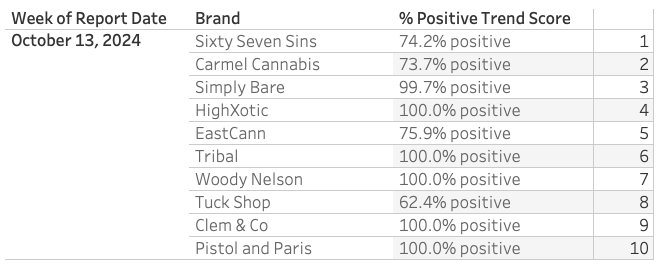

Week of October 13, 2024:

Sixty Seven Sins continues its dominance, securing the #1 spot for a third straight week, though its positive sentiment declined slightly to 74.2%. Carmel Cannabis moved up from #3 to #2, despite a drop in positive sentiment to 73.7%. Simply Bare showed staying power, moving up to #3 with an impressive 99.7% positive rating.

HighXotic maintained its presence in the top 10, climbing from #9 to #4 while keeping its perfect 100% sentiment score. EastCann made its first appearance at #5 with 75.9% positive reviews.

Tribal returned to the top 10 at #6 after a one-week absence, posting a perfect sentiment score. Woody Nelson held relatively steady, moving from #10 to #7, maintaining its 100% positive rating.

New entries this week:

- Tuck Shop debuting at #8 (62.4% positive - this week's lowest sentiment)

- Clem & Co at #9 (100% positive)

- Pistol and Paris at #10 (100% positive)

Notable exits:

- 1964 (previously #2)

- MTL (previously #4)

- Northern Canna (previously #6)

- Kolab (previously #7)

- Kwall (previously #8)

Streak Watch:

- Sixty Seven Sins: 3 weeks at #1

- Simply Bare: 3 consecutive weeks in top 10

- Woody Nelson: 3 consecutive weeks in top 10

This week featured six brands with 100% positive sentiment, showing strong product satisfaction across multiple entries.

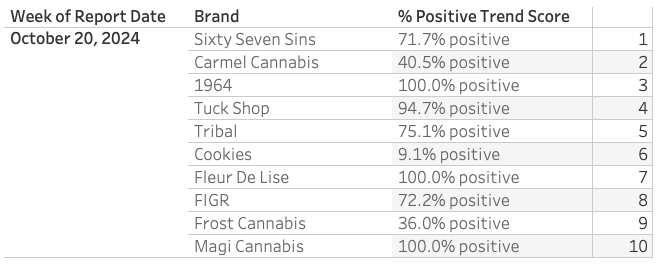

Week of October 20, 2024:

Sixty Seven Sins extends its remarkable run at #1 to four consecutive weeks, though showing a continued gradual decline in positive sentiment (now 71.7%). Carmel Cannabis maintained its #2 position but experienced a dramatic drop in positive sentiment from 73.7% to 40.5%.

1964 made a strong return to the top 10, landing at #3 with a perfect 100% positive rating. Tuck Shop showed impressive momentum, climbing from #8 to #4 with improved sentiment of 94.7%. Tribal slipped slightly from #6 to #5, with sentiment holding relatively steady at 75.1%.

New entries this week:

- Cookies debuting at #6 (notably low 9.1% positive sentiment)

- Fleur De Lise at #7 (perfect 100% sentiment)

- FIGR at #8 (72.2% positive)

- Frost Cannabis at #9 (concerning 36% positive)

- Magi Cannabis at #10 (perfect 100% positive)

Notable exits:

- Simply Bare (breaking a 3-week streak)

- HighXotic

- EastCann

- Woody Nelson (breaking a 3-week streak)

- Clem & Co

- Pistol and Paris

Streak Watch:

- Sixty Seven Sins: 4 weeks at #1

- Carmel Cannabis: 2 weeks in top 2

- Tuck Shop: 2 consecutive weeks in top 10

- Tribal: 2 consecutive weeks in top 10

This week showed the widest sentiment range yet, from Cookies' 9.1% to perfect 100% scores from three brands. The volatility in sentiment scores and significant turnover in the top 10 suggests an interesting week in the cannabis community.

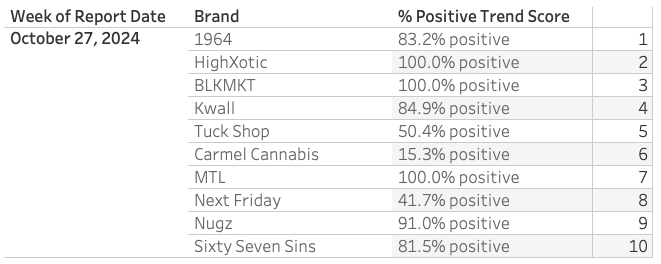

Week of October 27, 2024:

A major shakeup this week as 1964 claims the top spot, ending Sixty Seven Sins' impressive four-week reign at #1. 1964 returns with 83.2% positive sentiment, while Sixty Seven Sins drops to #10 (81.5% positive), marking its fifth consecutive week in the top 10 but first time outside the top spot.

HighXotic makes a strong return at #2 with a perfect 100% sentiment, and BLKMKT resurfaces in the top 10 at #3, also with 100% positive reviews. Kwall returns at #4 with a strong 84.9% positive rating.

Tuck Shop continues its top 10 streak for a third week, sliding to #5 with sentiment dropping to 50.4%. Carmel Cannabis sees another significant decline, dropping to #6 with concerning 15.3% positive sentiment - a dramatic fall from its recent #2 position and 40.5% rating last week.

New entries this week:

- MTL returns at #7 (perfect 100% sentiment)

- Next Friday debuts at #8 (41.7% positive)

- Nugz debuts at #9 (strong 91% positive)

Notable exits:

- Tribal (breaking 2-week streak)

- Cookies

- Fleur De Lise

- FIGR

- Frost Cannabis

- Magi Cannabis

Streak Watch:

- Sixty Seven Sins: 5 consecutive weeks in top 10 (though reign at #1 ends)

- Tuck Shop: 3 consecutive weeks

- Carmel Cannabis: 3 consecutive weeks (with declining sentiment)

This week shows significant volatility in both rankings and sentiment, with three brands achieving perfect scores while others struggle with sub-50% ratings. The contrast between top performers and those with declining sentiment continues to widen.

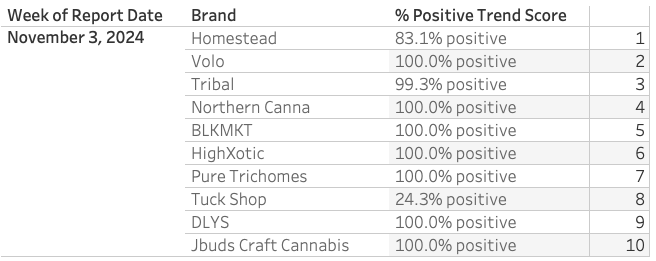

Week of November 3, 2024:

Another major shakeup as Homestead claims #1 with 83.1% positive sentiment, while last week's leader 1964 exits the top 10 entirely. Volo debuts impressively at #2 with a perfect 100% rating. Tribal makes a strong return at #3 with near-perfect 99.3% positive sentiment.

BLKMKT maintains its presence in the top 10, moving from #3 to #5 while keeping its perfect 100% sentiment. Similarly, HighXotic stays in the rankings but slides from #2 to #6, maintaining its 100% positive rating.

Tuck Shop continues its remarkable streak for a fourth consecutive week, though dropping to #8 with a concerning decline in sentiment to 24.3% (down from 50.4% last week).

New entries this week:

- Northern Canna returns at #4 (100% positive)

- Pure Trichomes debuts at #7 (100% positive)

- DLYS debuts at #9 (100% positive)

- Jbuds Craft Cannabis debuts at #10 (100% positive)

Notable exits:

- Sixty Seven Sins (ending 5-week streak)

- Carmel Cannabis (ending 3-week streak)

- MTL

- Next Friday

- Nugz

- Kwall

Streak Watch:

- Tuck Shop: 4 consecutive weeks (though with declining sentiment)

- BLKMKT: 2 consecutive weeks at 100% positive

- HighXotic: 2 consecutive weeks at 100% positive

This week sets a new record with eight brands achieving 100% positive sentiment. However, the stark contrast between these perfect scores and Tuck Shop's 24.3% highlights the volatility in consumer satisfaction.

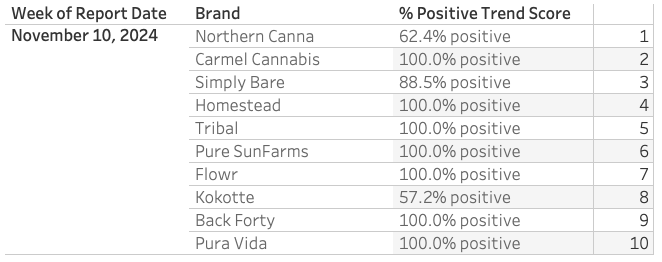

Week of November 10, 2024:

Northern Canna makes a power move from #4 to #1, though with a decreased sentiment of 62.4% (down from last week's perfect score). Carmel Cannabis makes a dramatic return to the top 10 at #2, rebounding with a perfect 100% positive rating - a remarkable turnaround from its previous 15.3% sentiment two weeks ago.

Simply Bare returns to the rankings at #3 with 88.5% positive sentiment. Last week's #1, Homestead, drops to #4 but maintains a perfect 100% rating. Tribal holds strong for a second consecutive week, moving from #3 to #5 while maintaining 100% positive sentiment.

New entries this week:

- Pure SunFarms debuts at #6 (100% positive)

- Flowr debuts at #7 (100% positive)

- Kokotte debuts at #8 (57.2% positive)

- Back Forty debuts at #9 (100% positive)

- Pura Vida debuts at #10 (100% positive)

Notable exits:

- Volo (after strong #2 debut)

- BLKMKT (ending 2-week streak)

- HighXotic (ending 2-week streak)

- Pure Trichomes

- Tuck Shop (ending 4-week streak)

- DLYS

- Jbuds Craft Cannabis

Streak Watch:

- Tribal: 2 consecutive weeks

- Northern Canna: 2 consecutive weeks

- Homestead: 2 consecutive weeks

This week continues the trend of multiple perfect scores, with seven brands achieving 100% positive sentiment. The significant turnover in the top 10 (7 new entries) suggests high competition and volatility in the market.

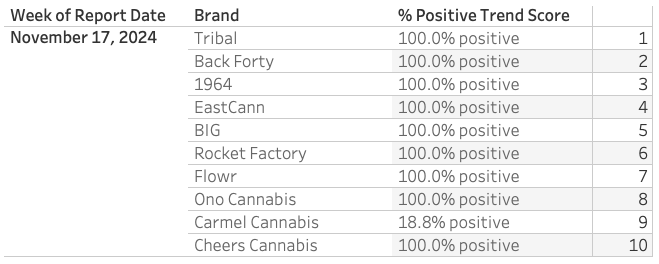

Week of November 17, 2024:

Tribal continues its impressive run, climbing from #5 to claim the #1 spot while maintaining its perfect 100% sentiment for a third straight week. Back Forty moves up from #9 to #2, keeping its 100% positive rating. 1964 makes a strong return to the top 10 at #3, also with perfect sentiment.

This week sets a new record with nine out of ten brands achieving 100% positive sentiment. The only exception is Carmel Cannabis at #9, which sees another dramatic sentiment drop to 18.8% (down from 100% last week).

New entries this week:

- EastCann debuts at #4 (100% positive)

- BIG debuts at #5 (100% positive)

- Rocket Factory debuts at #6 (100% positive)

- Ono Cannabis returns at #8 (100% positive)

- Cheers Cannabis debuts at #10 (100% positive)

Notable exits:

- Northern Canna (ending 2-week streak, last week's #1)

- Simply Bare

- Homestead (ending 2-week streak)

- Pure SunFarms

- Kokotte

- Pura Vida

Streak Watch:

- Tribal: 3 consecutive weeks

- Back Forty: 2 consecutive weeks

- Flowr: 2 consecutive weeks (holding at #7)

- Carmel Cannabis: 2 consecutive weeks (with volatile sentiment)

This week shows remarkable consistency in sentiment scores, though the continued volatility in Carmel Cannabis's performance and significant turnover in the top 10 (6 new entries) demonstrates the dynamic nature of brand performance.

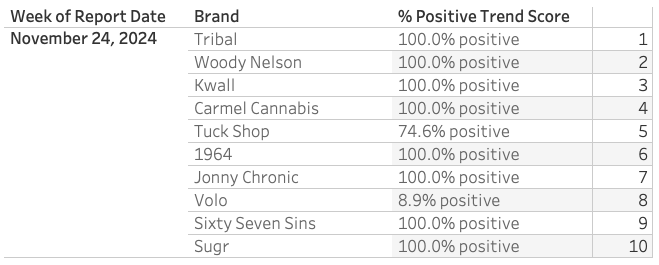

Week of November 24, 2024:

Tribal maintains its dominance at #1 for a second consecutive week, extending its streak to four weeks in the top 10 with consistent 100% positive sentiment. Woody Nelson makes a strong return at #2 (100% positive), having been absent since October 20th. Kwall also returns at #3 with perfect sentiment.

Carmel Cannabis achieves a remarkable turnaround, maintaining its top 10 position but jumping to #4 with 100% positive sentiment - a dramatic improvement from last week's 18.8%. Tuck Shop makes a return at #5 with 74.6% positive sentiment after a two-week absence.

1964 slips from #3 to #6 but maintains its perfect sentiment score. Sixty Seven Sins returns at #9 with 100% positive sentiment, making its first appearance since ending its initial 5-week streak.

New entries this week:

- Jonny Chronic debuts at #7 (100% positive)

- Volo returns at #8 (concerning 8.9% positive)

- Sugr debuts at #10 (100% positive)

Notable exits:

- Back Forty (ending 2-week streak)

- EastCann

- BIG

- Rocket Factory

- Flowr (ending 2-week streak)

- Ono Cannabis

- Cheers Cannabis

Streak Watch:

- Tribal: 4 consecutive weeks (2 weeks at #1)

- Carmel Cannabis: 3 consecutive weeks (with highly volatile sentiment)

- 1964: 2 consecutive weeks at 100% positive

This week features eight brands with 100% positive sentiment, but also shows extreme contrasts with Volo's 8.9% - the second-lowest sentiment score we've seen this quarter. The return of several previously successful brands (Woody Nelson, Sixty Seven Sins) adds an interesting dynamic to the rankings.

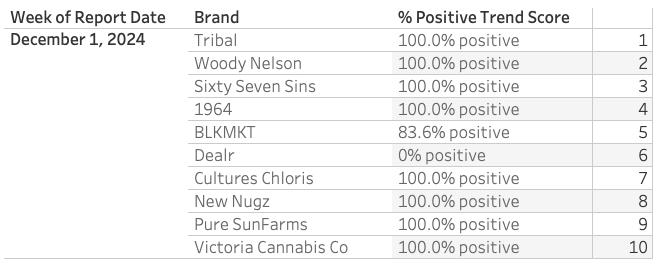

Week of December 1, 2024:

Tribal continues its remarkable run, holding #1 for a third straight week and extending its streak to five consecutive weeks in the top 10, maintaining perfect 100% sentiment. Woody Nelson stays strong at #2 for a second week, also keeping its 100% positive rating.

Sixty Seven Sins moves up from #9 to #3, maintaining perfect sentiment, while 1964 drops slightly from #6 to #4 but keeps its 100% positive streak alive for a third week. BLKMKT returns to the top 10 at #5 with 83.6% positive sentiment.

New entries this week:

- Dealr debuts at #6 (0% positive - the lowest sentiment score this quarter)

- Cultures Chloris debuts at #7 (100% positive)

- New Nugz debuts at #8 (100% positive)

- Pure SunFarms returns at #9 (100% positive)

- Victoria Cannabis Co debuts at #10 (100% positive)

Notable exits:

- Carmel Cannabis (ending 3-week streak)

- Tuck Shop

- Jonny Chronic

- Volo

- Sugr

Streak Watch:

- Tribal: 5 consecutive weeks (3 weeks at #1)

- Woody Nelson: 2 consecutive weeks at #2

- Sixty Seven Sins: 2 consecutive weeks

- 1964: 3 consecutive weeks

This week presents another strong showing of perfect sentiment scores, with eight brands at 100% positive. However, the stark contrast of Dealr's 0% positive rating represents the lowest sentiment score we've seen this quarter. The top 4 positions show remarkable stability with established brands, while the lower ranks continue to see significant turnover.

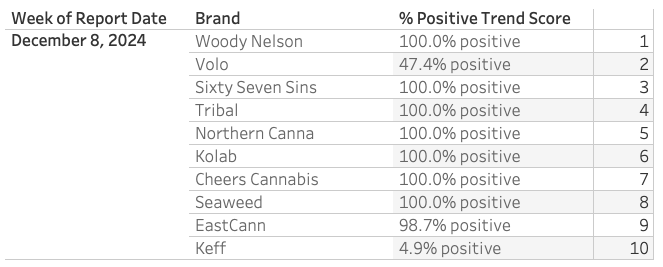

Week of December 8, 2024:

Woody Nelson claims the top spot, moving up from #2 and maintaining its perfect sentiment for a third consecutive week. Volo makes another volatile return at #2 with 47.4% positive sentiment - a significant improvement from its recent 8.9% but still well below the week's average.

Sixty Seven Sins holds steady at #3 for a third consecutive week with 100% positive sentiment. Tribal's three-week reign at #1 ends as it moves to #4, though it maintains both its perfect sentiment and its impressive streak of six consecutive weeks in the top 10.

Northern Canna returns at #5 with 100% positive sentiment, its first appearance since leading the rankings in mid-November.

New entries this week:

- Kolab returns at #6 (100% positive)

- Cheers Cannabis returns at #7 (100% positive)

- Seaweed debuts at #8 (100% positive)

- EastCann returns at #9 (98.7% positive)

- Keff debuts at #10 (concerning 4.9% positive)

Notable exits:

- 1964 (ending 3-week streak)

- BLKMKT

- Dealr

- Cultures Chloris

- New Nugz

- Pure SunFarms

- Victoria Cannabis Co

Streak Watch:

- Tribal: 6 consecutive weeks

- Woody Nelson: 3 consecutive weeks

- Sixty Seven Sins: 3 consecutive weeks

This week maintains the pattern of predominantly high sentiment scores, with seven brands achieving 100% positive ratings. However, the inclusion of two brands below 50% positive (Volo and Keff) continues to demonstrate the volatility in consumer satisfaction.

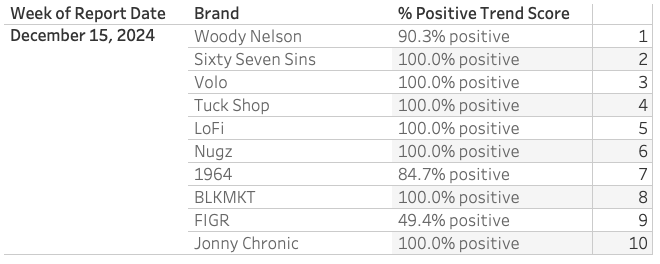

Week of December 15, 2024:

Woody Nelson maintains its #1 position for a second straight week, though its perfect streak ends with a slight dip to 90.3% positive sentiment. Sixty Seven Sins moves up one spot to #2, maintaining its perfect 100% rating for a fourth consecutive week.

Volo continues its volatile journey, climbing from #2 to #3 with a dramatic improvement to 100% positive sentiment (up from 47.4% last week). Tuck Shop returns to the top 10 at #4 with a perfect score, showing strong recovery from its previous appearances.

New entries this week:

- LoFi debuts at #5 (100% positive)

- Nugz returns at #6 (100% positive)

- 1964 returns at #7 (84.7% positive)

- BLKMKT returns at #8 (100% positive)

- FIGR returns at #9 (49.4% positive)

- Jonny Chronic returns at #10 (100% positive)

Notable exits:

- Tribal (ending impressive 6-week streak)

- Northern Canna

- Kolab

- Cheers Cannabis

- Seaweed

- EastCann

- Keff

Streak Watch:

- Woody Nelson: 4 consecutive weeks (2 weeks at #1)

- Sixty Seven Sins: 4 consecutive weeks

- Volo: 2 consecutive weeks (with dramatically improved sentiment)

This week shows strong overall sentiment with seven brands achieving 100% positive ratings. The exit of long-running streak holder Tribal marks a significant change in the rankings. The continued presence of lower sentiment scores (FIGR at 49.4%) maintains the pattern of varied consumer satisfaction we've seen throughout Q4.

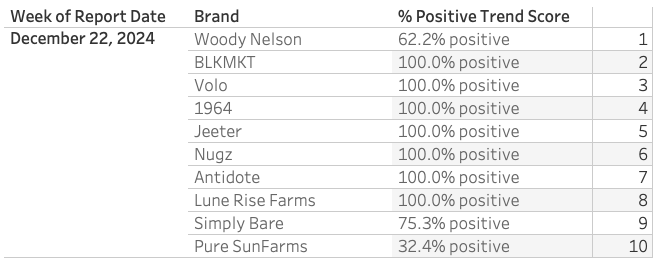

Week of December 22, 2024:

Woody Nelson achieves a remarkable feat, holding #1 for a third consecutive week despite a significant drop in sentiment to 62.2% (down from 90.3%). This marks its fifth straight week in the top 10. BLKMKT moves up from #8 to #2 with perfect sentiment, while Volo maintains its position at #3, keeping its 100% positive rating for a third consecutive week.

1964 climbs from #7 to #4, returning to perfect sentiment at 100% positive. Nugz holds steady at #6, maintaining its perfect score from last week.

New entries this week:

- Jeeter debuts at #5 (100% positive)

- Antidote debuts at #7 (100% positive)

- Lune Rise Farms debuts at #8 (100% positive)

- Simply Bare returns at #9 (75.3% positive)

- Pure SunFarms returns at #10 (concerning 32.4% positive)

Notable exits:

- Sixty Seven Sins (ending impressive 4-week streak)

- Tuck Shop

- LoFi

- FIGR

- Jonny Chronic

Streak Watch:

- Woody Nelson: 5 consecutive weeks (3 weeks at #1)

- Volo: 3 consecutive weeks

- BLKMKT: 2 consecutive weeks

- 1964: 2 consecutive weeks

- Nugz: 2 consecutive weeks

This week continues the trend of predominantly high sentiment scores, with seven brands achieving 100% positive ratings. However, Pure SunFarms' 32.4% represents one of the lower scores we've seen this quarter. The consistent presence of Woody Nelson at #1, despite varying sentiment scores, suggests strong overall brand performance beyond just positive ratings.

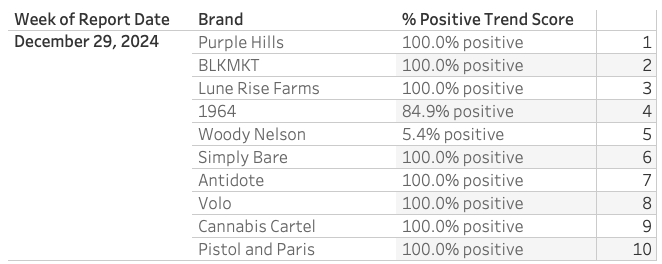

Week of December 29, 2024 - Final Week of Q4:

The quarter ends with a dramatic shift as Purple Hills claims #1 with a perfect 100% sentiment score. BLKMKT maintains its high position, moving from #2 to #3 while keeping its perfect rating for a third consecutive week. Lune Rise Farms makes an impressive climb from #8 to #3, maintaining 100% positive sentiment.

1964 holds in the top 5 at #4 with 84.9% positive sentiment, while Woody Nelson's reign at #1 ends as it drops to #5 with a further decline in sentiment to 5.4% - a dramatic fall from its earlier performance.

Simply Bare improves from #9 to #6, achieving perfect sentiment (up from 75.3%). Volo slips to #8 but maintains its perfect rating for a fourth consecutive week.

New entries this week:

- Cannabis Cartel debuts at #9 (100% positive)

- Pistol and Paris returns at #10 (100% positive)

Notable exits:

- Jeeter

- Nugz (ending 2-week streak)

- Pure SunFarms

Final Streak Watch:

- BLKMKT: 3 consecutive weeks

- Volo: 4 consecutive weeks

- 1964: 3 consecutive weeks

- Woody Nelson: ends Q4 with 6 consecutive weeks in top 10

- Lune Rise Farms: 2 consecutive weeks

The quarter ends with remarkable sentiment performance: nine out of ten brands achieving 100% positive ratings, with only Woody Nelson (5.4%) and 1964 (84.9%) falling short of perfect scores. This final week showcases the volatile nature of brand performance we've seen throughout Q4, with even established leaders like Woody Nelson experiencing significant sentiment swings.

Q4 2024 Cannabis Brand Performance - Key Trends and Patterns

Notable Streaks & Consistency

- Sixty Seven Sins: Started Q4 with an impressive 4-week run at #1, followed by another strong 4-week streak later

- Tribal: Achieved the quarter's longest consistent run with 6 consecutive weeks in top 10, including 3 weeks at #1

- Woody Nelson: Closed Q4 with 6 consecutive weeks in top 10, including 3 weeks at #1, though with volatile sentiment

- Most brands struggled to maintain presence for more than 2-3 consecutive weeks

Sentiment Volatility

- Several brands showed dramatic week-to-week swings:

- Carmel Cannabis: Ranged from 15.3% to 100%

- Volo: Fluctuated between 8.9% and 100%

- Woody Nelson: Final weeks saw decline from 100% to 5.4%

- Perfect scores (100%) were common but rarely sustained

- Lowest sentiment scores: Dealr (0%), Cookies (9.1%), Volo (8.9%)

Brand Tier Movement

- Top performers frequently moved between tiers

- Few brands maintained consistent tier positioning

- Weekly rankings showed high turnover (averaging 5-7 new entries per week)

Market Dynamics

- Strong competition at the top with frequent leadership changes

- Brand performance often independent of size/market presence

- Consumer sentiment proved highly dynamic and unpredictable

- Perfect sentiment scores didn't guarantee continued top 10 presence

Key Success Patterns

- Brands achieving extended stays in top 10 typically showed:

- Initial strong sentiment scores

- Consistent product quality

- Regular community engagement

- Ability to recover from occasional sentiment dips

This analysis suggests a highly competitive market where maintaining consistent performance is challenging, and consumer sentiment can shift rapidly. Success requires both quality products and sustained community engagement.

Thanks for following our Q4 2024 brand analysis. This concludes our quantitative deep-dive into brand performance and consumer sentiment patterns. For those interested in conducting their own analysis, you can access our complete dataset in CSV format on our raw data page at budtrendz.com/data. If you need specific insights or custom analytics, don't hesitate to reach out to our data team at data@budtrendz.com.

Coming Up: Consumer Voice & Product Details

In our next series of posts, we'll shift focus to the qualitative aspects of consumer feedback. We'll examine:

- Standout reviewer comments and insights

- Common themes across product categories

- Recurring praise and criticism patterns

- Detailed sensory analysis across brands

- Product-specific trends and observations

Stay tuned as we dive into the actual voice of the cannabis community, moving beyond the numbers to understand what consumers are really saying about their experiences.