Q4 2024: Cannabis Brand Performance Analysis

Measuring Brand Impact Through Reddit Users' Votes, Comments & Sentiment

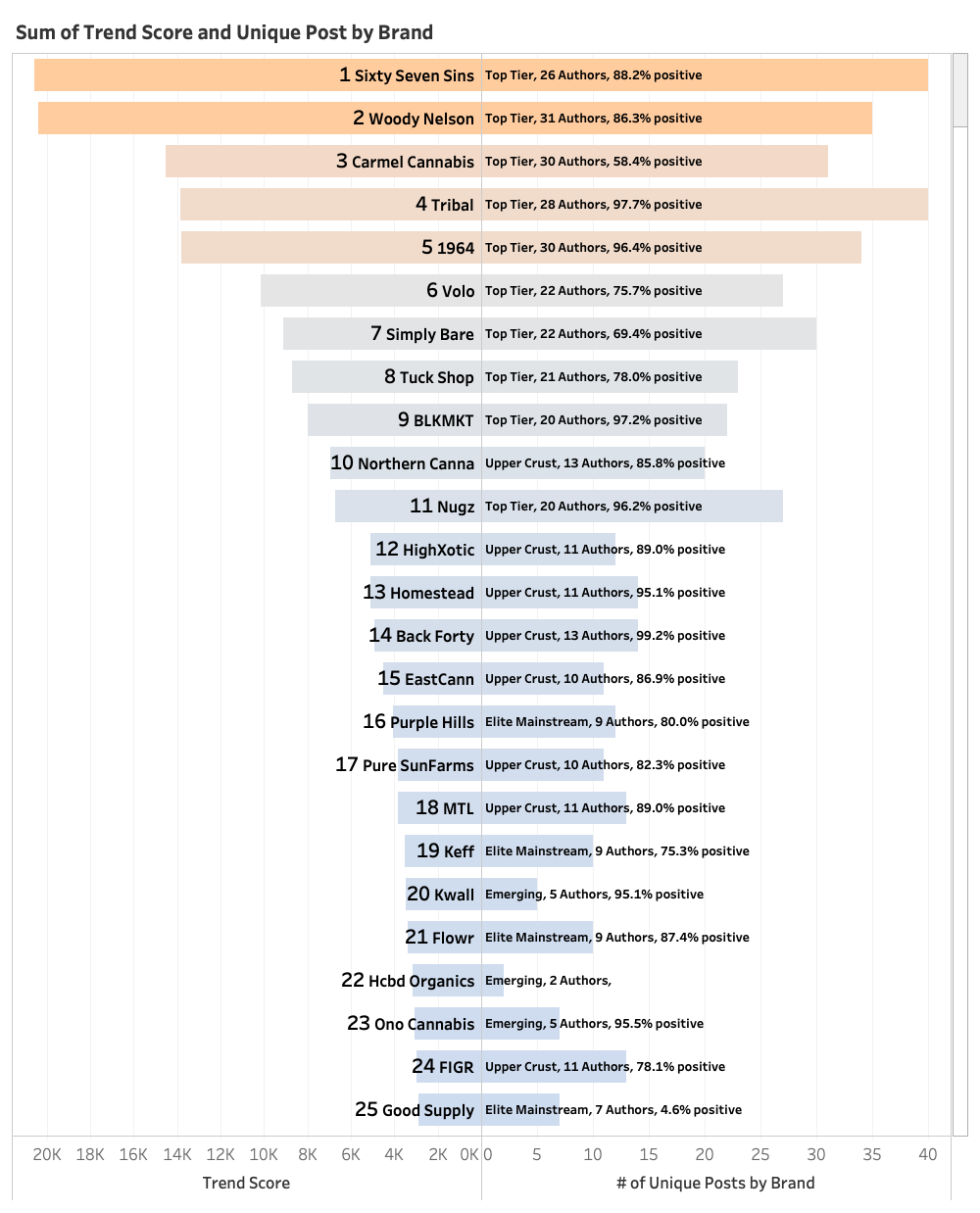

Building on our previous analysis of author engagement patterns, we now examine reader activity through our Trend Score metric, which combines upvotes, downvotes, and comments. This provides a comprehensive view of how brands resonate within our tracked Reddit community of 215,000 subscribers across six cannabis-focused subreddits.

Haven't Read Our Q4 2024 Cannabis Brand Engagement Analysis: Reddit Community Activity Patterns Yet?

📊 For Essential Context Behind Today's Numbers...

Check back to our Brand Engagement Analysis that provides rationale for the brand groupings used in this post. The previous analysis covers:

• Complete breakdown of 375 brands across 33 product types

• Detailed engagement metrics from 215,000 community members

• Brand classification system explaining our tiering methodology

• Key benchmarks for brand performance

• Baseline metrics that inform today's comparisons

👉 Read "Q4 2024 Cannabis Brand Engagement Analysis: Reddit Community Activity Patterns"

Top 5 Performers by Trend Score (Q4 2024)

- Sixty Seven Sins (Top Tier)

- 40 unique posts

- 88.2% positive sentiment

- 26 unique authors

- Highest overall Trend Score

- Woody Nelson (Top Tier)

- 35 unique posts

- 86.3% positive sentiment

- Leading author diversity (31 unique)

- Second-highest Trend Score

- Carmel Cannabis (Top Tier)

- 31 unique posts

- 58.4% positive sentiment

- 30 unique authors

- Notable engagement despite lower positive sentiment

- Tribal (Top Tier)

- 40 unique posts

- Outstanding 97.7% positive sentiment

- 28 unique authors

- Highest post volume tied with Sixty Seven Sins

- 1964 (Top Tier)

- 34 unique posts

- 96.4% positive sentiment

- 30 unique authors

- Consistently high engagement and sentiment

Key Insights

The data reveals interesting patterns across our brand segments:

- Top Tier brands dominate the highest Trend Scores

- High post volume doesn't always correlate with positive sentiment (see Carmel Cannabis)

- Some brands achieve remarkable sentiment scores (Back Forty: 99.2% positive)

Post volume and author count (discussed in our previous article) are important metrics, reader engagement and sentiment provide crucial additional context for understanding brand performance in the cannabis community.

Accessing Detailed Sentiment Data

For brands interested in diving deeper into positivity ratings and sentiment analysis, we offer two options:

- Download our raw data package for Q4 2024, which includes detailed sentiment breakdowns

- Contact our data team directly at data@budtrendz.com to discuss custom analytics needs

Our granular data can help brands understand:

- Specific product performance within brand families

- Sentiment trends over time

- Regional variations in reception

- Detailed comment analysis

- Comparative performance metrics

Next, we'll break down the quarter's weekly "What's Hot" snapshots, tracking which brands made our top 10 lists by Trend Score heading into each weekend. Rather than revisiting each individual post, we'll analyze the weekly ebb and flow of brand momentum throughout Q4. This dynamic view reveals which brands maintained consistent popularity and which ones had breakout weeks, offering a different perspective from our quarterly aggregates.

Stay tuned to see how often your favourite brands cracked the top 10, and discover which brands showed surprising bursts of community engagement.