Q4 2024 Cannabis Brand Engagement Analysis: Reddit Community Activity Patterns

Our Q4 2024 analysis examines engagement patterns across six major cannabis subreddits, with a combined subscriber base of 215,000 members. We tracked 375 distinct brands across 33 different cannabis product types in the Canadian market, with a notable bias toward flower products.

Q4 2024 Performance Metrics

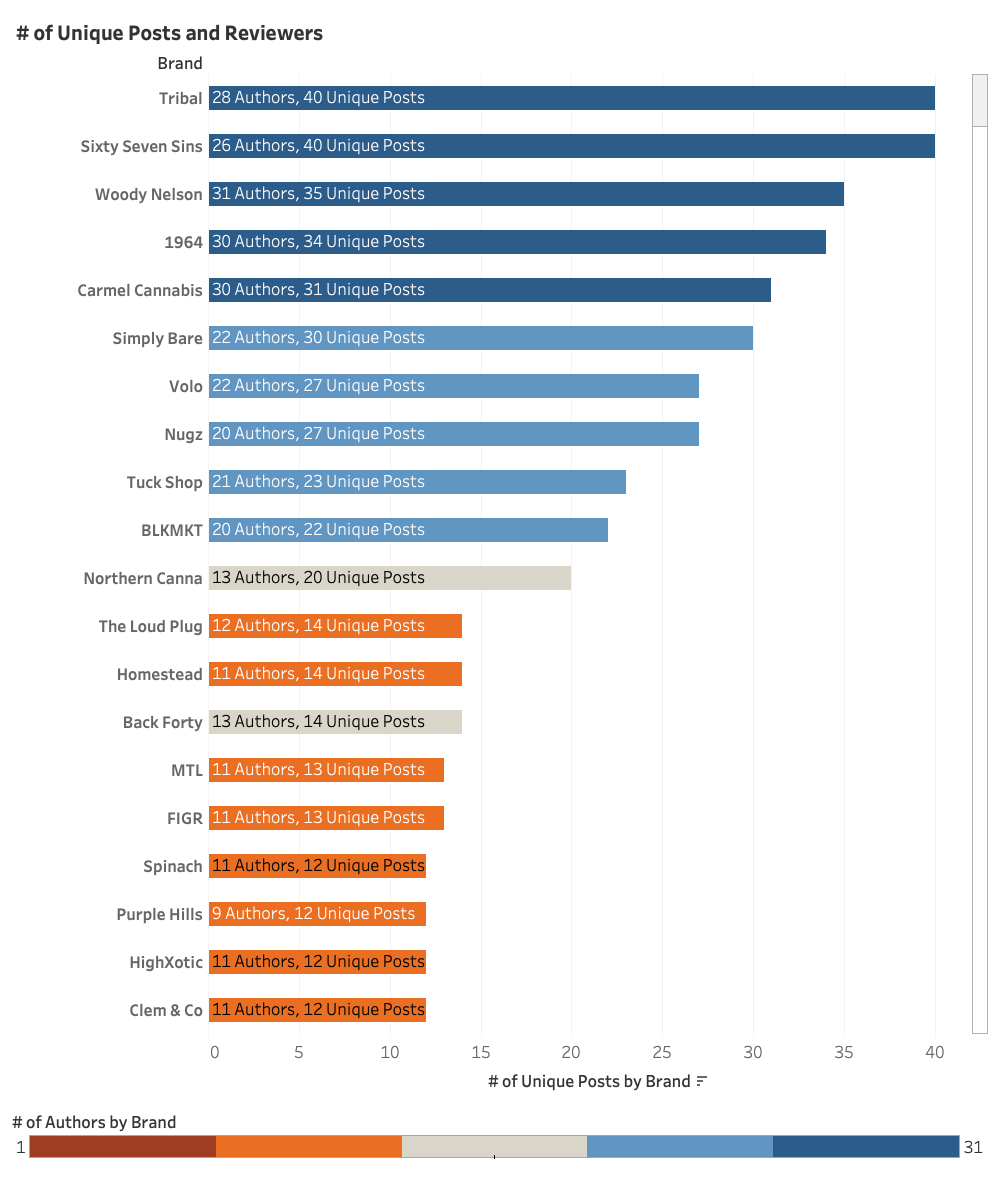

During this three-month period, we observed:

- Average of 3 unique authors per brand (roughly 1 per month)

- Average of 4 posts per brand

- Highest engagement: 40 unique posts (achieved by both Tribal and Sixty Seven Sins)

- Most diverse authorship: 31 unique reviewers (Woody Nelson)

Brand Categories by Activity Level

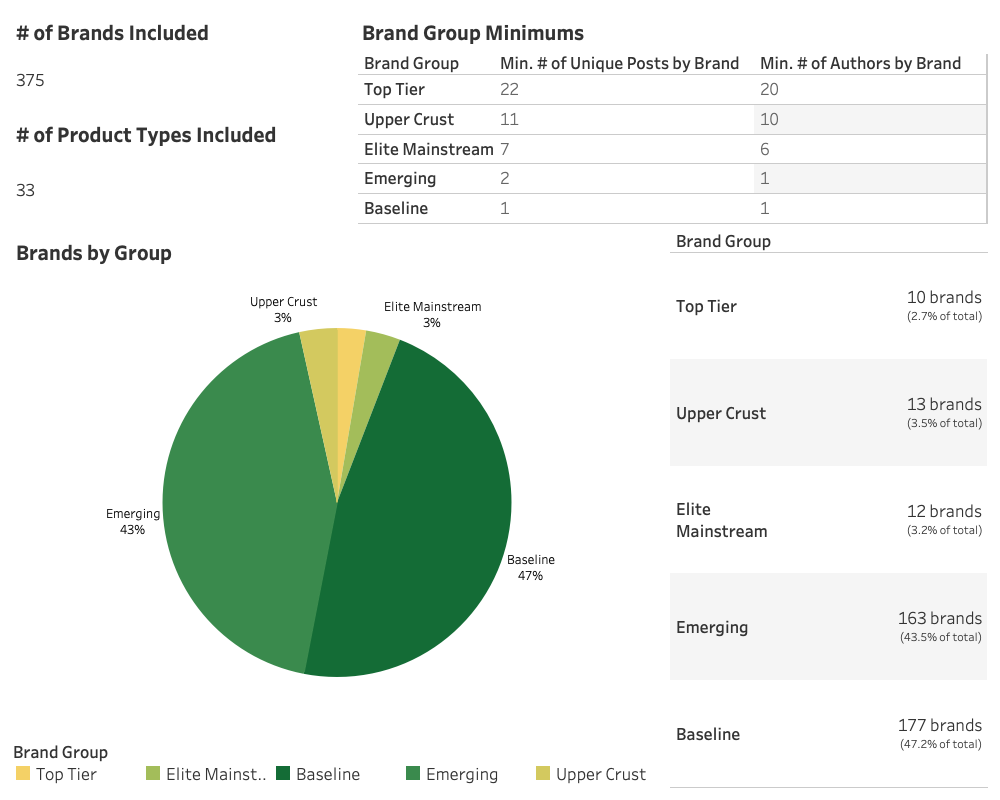

Based on Q4 2024 posting frequency and author diversity, brands clustered into five distinct groups:

Top Tier (2.7% of brands)

- Minimum 22 unique posts

- Minimum 20 unique authors

Upper Crust (3.5% of brands)

- Minimum 11 unique posts

- Minimum 10 unique authors

Elite Mainstream (3.2% of brands)

- Minimum 7 unique posts

- Minimum 6 unique authors

Emerging (43.5% of brands)

- Minimum 2 unique posts

- Minimum 1 unique author

Baseline (47.2% of brands)

- Minimum 1 unique post

- Minimum 1 unique author

Distribution Overview

Approximately 90% of brands fall within Baseline and Emerging categories, while the remaining 10% distribute across Top Tier, Upper Crust, and Elite Mainstream segments. Each of these top three segments contains 10-13 brands.

Lessons for Brand Engagement

For cannabis brands looking to maximize their Reddit presence across our tracked communities, Q4 2024 data suggests these clear benchmarks:

- To exceed market average: Secure at least 3 unique reviewers posting once per month

- To reach top 10%: Aim for 3-4 review posts monthly

- For category leadership: Target 6-8 unique posts monthly (double the top 10% threshold)

What's Next

In our next analysis, we'll examine our Trend Score metric for Q4 2024, which measures audience engagement through upvotes, downvotes, and comments. This will shift our focus from reviewer activity to audience reception, providing additional insights into brand performance across these cannabis communities.

Explore Our Data Further

Raw Data Access:

• Download our Q4 2024 datasets (CSV format):

- Complete sentiment analysis

- Brand performance metrics

Interactive Resources:

• Live Dashboards featuring:

- Real-time sentiment tracking

- Brand comparison tools

- Market trend visualizations

- Interactive infographics

For custom data requests or additional insights, email us at data@budtrendz.com

Our visualization suite helps industry professionals track and understand rapidly evolving cannabis market trends. Whether you're analyzing brand performance or researching market dynamics, our tools provide valuable insights for informed decision-making.

Visit our Raw Data page to access the Q4 2024 datasets and contact us explore our collection of live dashboard visualizations.