November 2025: Canadian Cannabis Brand Sentiment & Trend Report

November 2025 has delivered one of the most significant shifts we’ve seen in the Canadian cannabis market this year. The reign of the usual volume giants has been interrupted, with Avant Brands storming to the #1 spot, propelled by an unprecedented surge in community engagement for Tenzo.

But the story isn't just about who is talking; it's about what they are saying. Our latest data reveals a community that is becoming ruthlessly selective. While premium darlings like Simply Bare and Frost Cannabis secured flawless 10/10 sentiment scores, other major players faced a reckoning. Notable brands like Good Supply and even former community favorite Woody Nelson struggled with rising tides of negative feedback, highlighting a sharp polarization between "hype" and "satisfaction" in the current market.

From the aggregate leaderboard to the specific battlegrounds of r/TheOCS and r/CanadianCannabisLPs, here is the definitive breakdown of who won November.

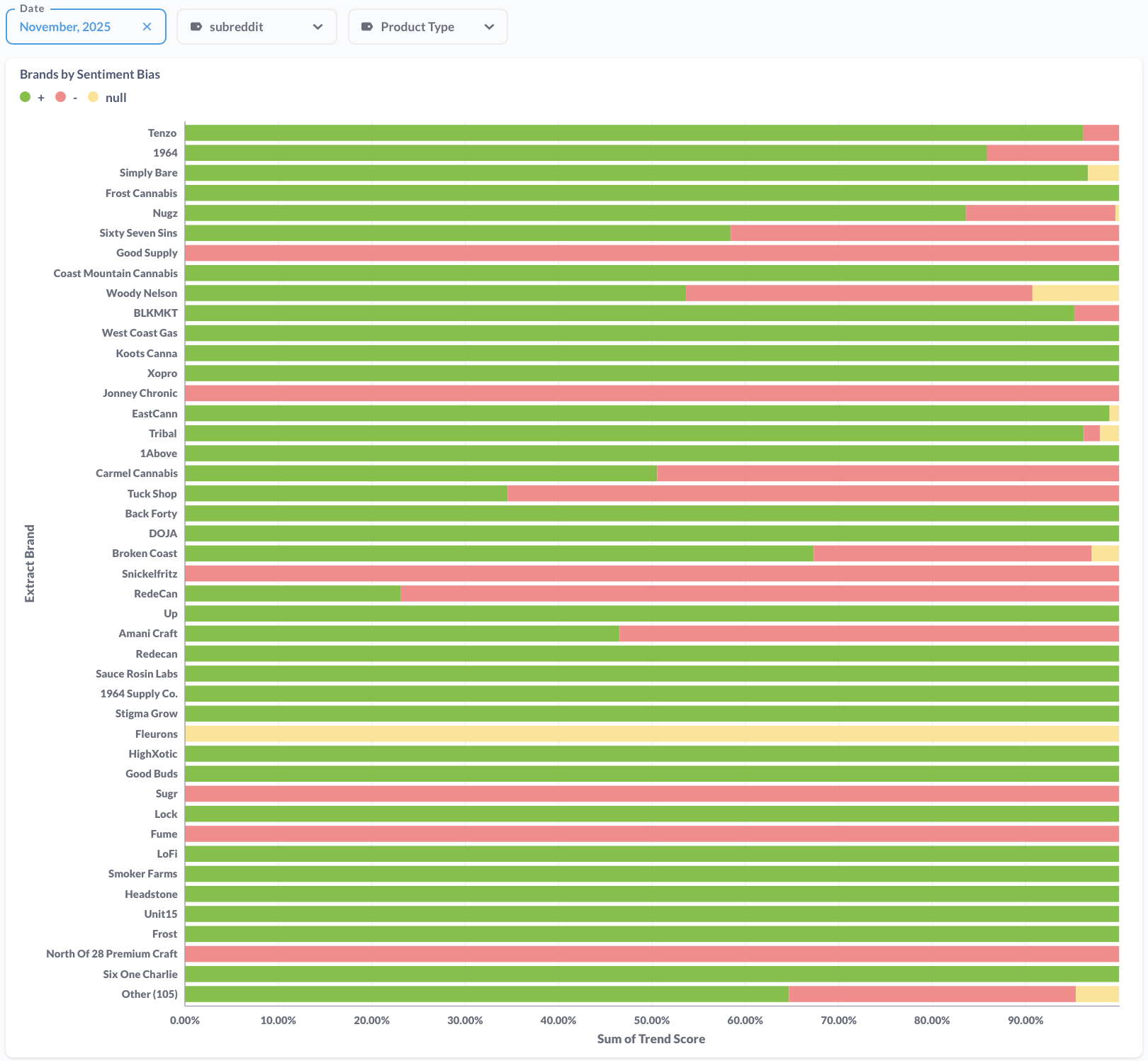

ALL PRODUCT TYPES - November 2025

The following data represents the aggregate activity across all product categories.

Tenzo dominates the month with massive volume and extremely high positive sentiment. The most notable insight is the Sentiment Bias—while brands like Simply Bare and Frost Cannabis managed to avoid any measurable negative sentiment this month, volume giants like Sixty Seven Sins and Woody Nelson saw a significant split, with nearly 40% of their trend score driven by negative or critical discussions.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Tenzo | 4,987 | 4,796 | 191 | 9.6 |

| 2 | Sixty Seven Sins | 3,591 | 2,098 | 1,493 | 5.8 |

| 3 | 1964 | 3,443 | 2,957 | 487 | 8.6 |

| 4 | Woody Nelson | 3,175 | 1,878 | 1,298 | 5.9 |

| 5 | Nugz | 2,979 | 2,501 | 478 | 8.4 |

| 6 | Simply Bare | 2,777 | 2,777 | 0 | 10.0 |

| 7 | Frost Cannabis | 2,614 | 2,614 | 0 | 10.0 |

| 8 | Good Supply | 2,046 | 0 | 2,046 | 0.0 |

| 9 | Coast Mountain Cannabis | 2,018 | 2,018 | 0 | 10.0 |

| 10 | BLKMKT | 1,917 | 1,826 | 91 | 9.5 |

| 11 | Carmel Cannabis | 1,916 | 969 | 947 | 5.1 |

| 12 | West Coast Gas | 1,699 | 1,699 | 0 | 10.0 |

| 13 | Koots Canna | 1,661 | 1,661 | 0 | 10.0 |

| 14 | Xopro | 1,522 | 1,522 | 0 | 10.0 |

| 15 | Jonney Chronic | 1,505 | 0 | 1,505 | 0.0 |

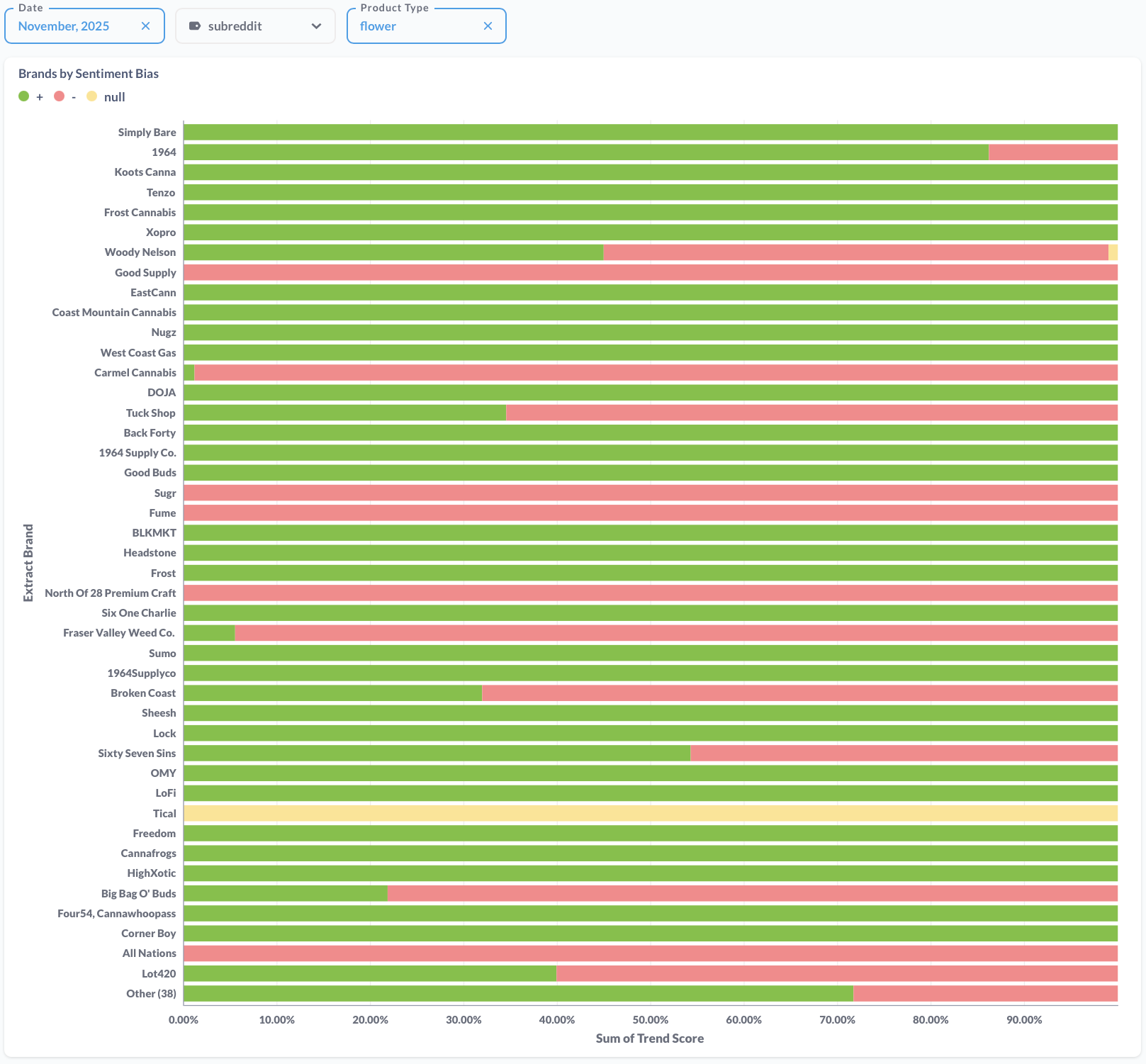

FLOWER - November 2025

The top Flower brands for the month.

The Flower category tells a different story than the aggregate data. 1964 takes the top spot for Flower specifically, though Tenzo drops down the list when isolating just this category. Woody Nelson sees significant engagement but also polarizing sentiment (4.5/10), while Good Supply's flower products faced exclusively negative sentiment this month.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | 1964 | 2,796 | 2,410 | 386 | 8.6 |

| 2 | Simply Bare | 2,551 | 2,551 | 0 | 10.0 |

| 3 | Woody Nelson | 2,378 | 1,080 | 1,298 | 4.5 |

| 4 | Koots Canna | 1,661 | 1,661 | 0 | 10.0 |

| 5 | Tenzo | 1,623 | 1,623 | 0 | 10.0 |

| 6 | Frost Cannabis | 1,384 | 1,384 | 0 | 10.0 |

| 7 | Xopro | 1,350 | 1,350 | 0 | 10.0 |

| 8 | Tuck Shop | 1,146 | 396 | 750 | 3.5 |

| 9 | Good Supply | 1,080 | 0 | 1,080 | 0.0 |

| 10 | EastCann | 986 | 986 | 0 | 10.0 |

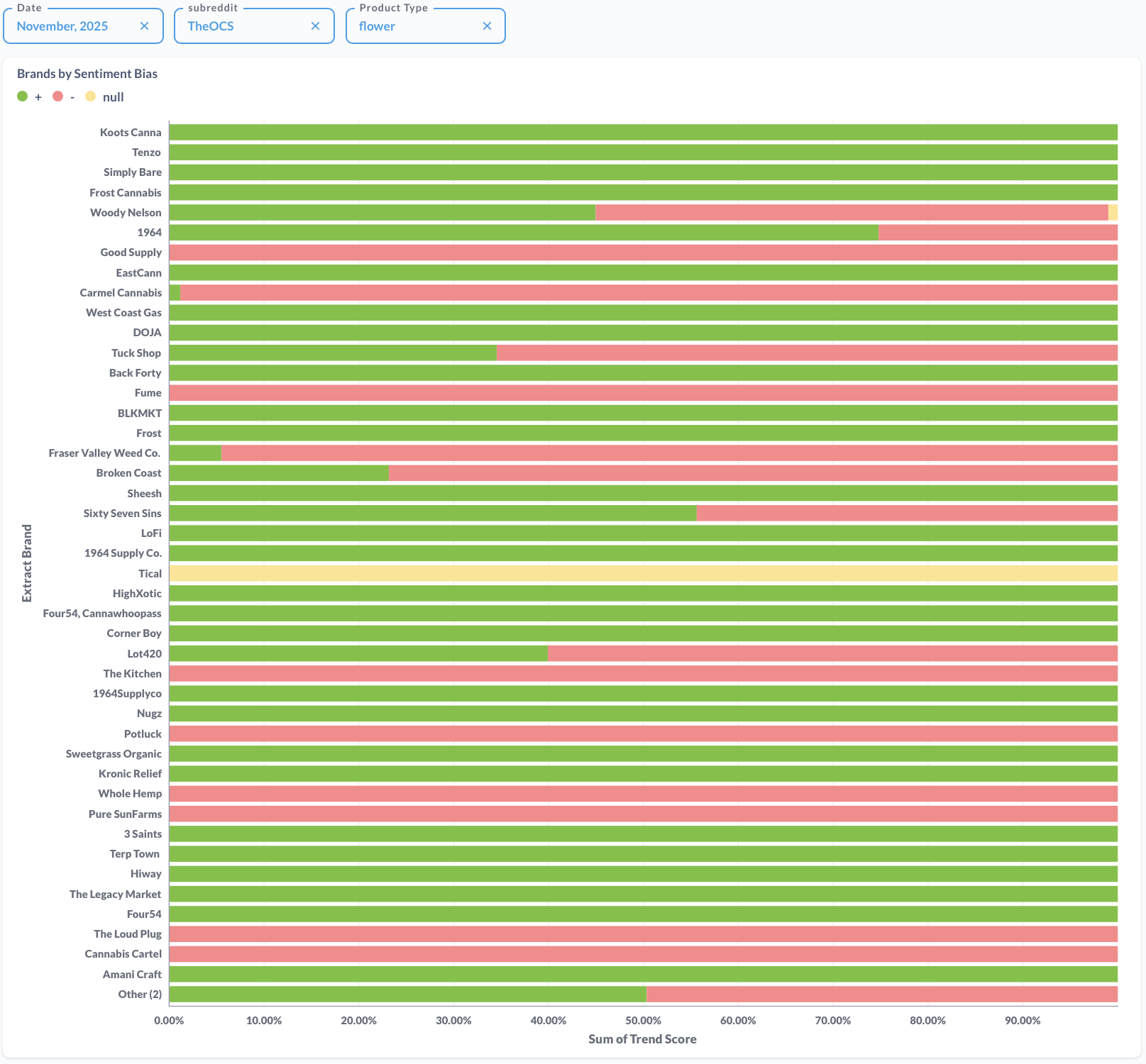

r/THEOCS FLOWER - November 2025

Top Flower brands discussed specifically on r/TheOCS.

On Canada's largest cannabis subreddit, Woody Nelson remains the most discussed flower brand, but the conversation is heated (4.5 sentiment). Koots Canna and Tenzo are the community darlings this month, generating significant volume with perfect sentiment scores.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Woody Nelson | 2,378 | 1,080 | 1,298 | 4.5 |

| 2 | Koots Canna | 1,661 | 1,661 | 0 | 10.0 |

| 3 | Tenzo | 1,623 | 1,623 | 0 | 10.0 |

| 4 | 1964 | 1,530 | 1,144 | 386 | 7.5 |

| 5 | Simply Bare | 1,524 | 1,524 | 0 | 10.0 |

| 6 | Frost Cannabis | 1,327 | 1,327 | 0 | 10.0 |

| 7 | Tuck Shop | 1,146 | 396 | 750 | 3.5 |

| 8 | Good Supply | 1,080 | 0 | 1,080 | 0.0 |

| 9 | EastCann | 986 | 986 | 0 | 10.0 |

| 10 | Carmel Cannabis | 867 | 10 | 856 | 0.1 |

r/CANADIANCANNABISLPS FLOWER - November 2025

Top Flower brands discussed on the medical-focused r/CanadianCannabisLPs.

The audience on r/CanadianCannabisLPs had a completely different focus. Coast Mountain Cannabis took the #1 spot with flawless feedback. Nugz also performed exceptionally well here compared to the general rec market. Interestingly, Sugr and North Of 28 appeared on the radar but with exclusively negative sentiment bias.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Coast Mountain Cannabis | 950 | 950 | 0 | 10.0 |

| 2 | Nugz | 711 | 711 | 0 | 10.0 |

| 3 | 1964 | 597 | 597 | 0 | 10.0 |

| 4 | Simply Bare | 536 | 536 | 0 | 10.0 |

| 5 | Sugr | 533 | 0 | 533 | 0.0 |

| 6 | Headstone | 470 | 470 | 0 | 10.0 |

| 7 | North Of 28 Premium Craft | 427 | 0 | 427 | 0.0 |

| 8 | Six One Charlie | 427 | 427 | 0 | 10.0 |

| 9 | Freedom | 262 | 262 | 0 | 10.0 |

| 10 | Happy Hour | 218 | 218 | 0 | 10.0 |

The Margin for Error is Gone

If November 2025 has taught us anything, it is that the Canadian cannabis consumer is becoming ruthlessly discerning. The days of "brand loyalty" protecting a producer from criticism are fading. As we saw with Woody Nelson this month, even community darlings are not immune to a swift sentiment reversal if product quality wavers or a release misses the mark.

Conversely, the data highlights a massive opportunity for consistency. Brands like Simply Bare, Frost Cannabis, and Coast Mountain Cannabis are proving that it is possible to maintain a flawless reputation—but it requires execution perfection. The "Sentiment Bias" metric is the new scorecard; in a market where volume is contracting, positive sentiment is the only currency that matters.

As we head into December and the holiday season, the pressure is on Avant Brands to defend their new crown, and on the legacy giants to repair the trust gaps revealed in this month's numbers.

Want deeper insights? Stay tuned to the BudTrendz blog for weekly updates, or contact us to see how your specific brand is trending in real-time.