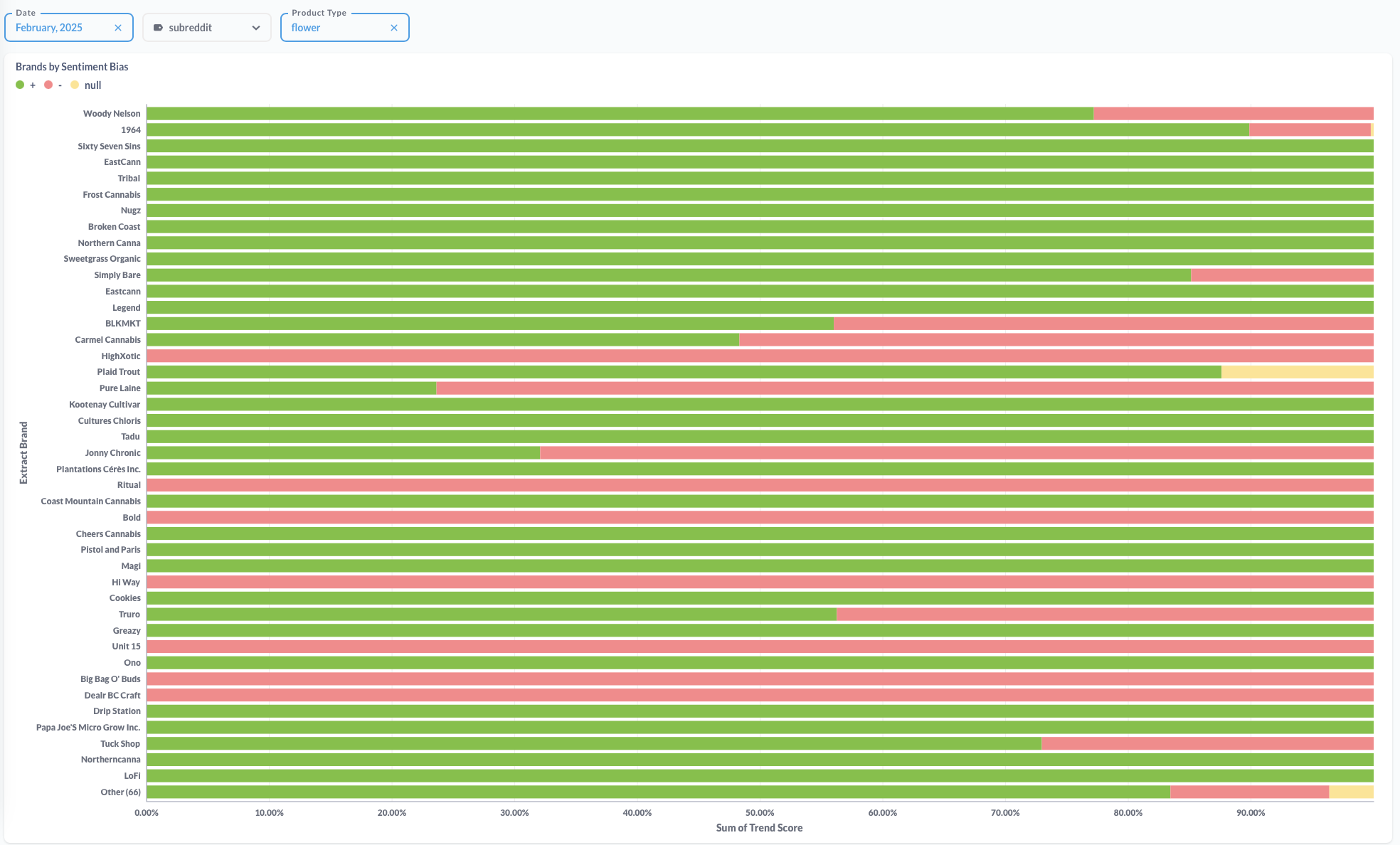

February 2025 Brand Sentiment Analysis - Flower Products

Analyzing February's flower-only reviews across cannabis subreddits reveals interesting shifts in consumer sentiment. Let's break down the data from our tracking of 98 brands:

Top Performers:

• Woody Nelson dominates with an impressive 8,260 positive trend score, though showing some polarization (2,439 negative)

• 1964 maintains strong performance with 5,360 positive points, despite some negative feedback (590)

• Sixty Seven Sins shows remarkable growth, reaching 5,157 positive points

• EastCann and Tribal round out the top 5 with approximately 2,600+ positive points each

Notable Trends:

• Premium Segment Strength:

- Frost Cannabis (1,840 positive)

- Broken Coast (1,718 positive)

- Northern Canna (1,450 positive)

- Sweetgrass Organic (1,336 positive)

Concerning Patterns:

• Several established brands showing significant polarization:

- Carmel Cannabis split between 731 positive/782 negative

- HighXotic struggling with 760 negative points

- Pure Laine facing challenges with 721 negative points

• Big Bag O' Buds continues to receive predominantly negative feedback (491 negative)

Market Evolution:

• Premium brands generally maintaining strong positive sentiment ratios

• Mid-market segment showing increased volatility

• "Other" category (66 brands) showing mostly positive sentiment with some neutral and negative feedback

Key Changes from January:

• Woody Nelson has emerged as the new sentiment leader, surpassing 1964's January dominance

• Sixty Seven Sins showed significant growth in positive sentiment

• More brands achieving pure positive sentiment scores

• Increased polarization among mid-tier brands

This analysis represents a snapshot of consumer sentiment across Canadian cannabis subreddits, offering valuable insights into market trends and consumer preferences in early 2025.

The chart above is a copy of a live dashboard tracking cannabis brand sentiment across 6 subreddits and multiple cannabis product types. We're looking for feedback on the platform.

Explore Our Data Further

Raw Data Access:

• Download our Q4 2024 datasets (CSV format):

- Complete sentiment analysis

- Brand performance metrics

Interactive Resources:

• Live Dashboards featuring:

- Real-time sentiment tracking

- Brand comparison tools

- Market trend visualizations

- Interactive infographics

For custom data requests or additional insights, email us at data@budtrendz.com

Our visualization suite helps industry professionals track and understand rapidly evolving cannabis market trends. Whether you're analyzing brand performance or researching market dynamics, our tools provide valuable insights for informed decision-making.

Visit our Raw Data page to access the Q4 2024 datasets and contact us explore our collection of live dashboard visualizations.