December 2025: Canadian Cannabis Brand Sentiment & Trend Report

December 2025 has delivered one of the most significant shifts we’ve seen in the Canadian cannabis market this year. The holiday season has brought a wave of high volume, but the story isn't just about who is talking; it's about what they are saying. Our latest data reveals a community that is becoming ruthlessly selective and increasingly vocal about batch consistency.

While premium mainstays like West Coast Gas and Tenzo secured flawless 10.0 sentiment scores, other major players faced a reckoning. Notable brands like Woody Nelson and Carmel Cannabis struggled with rising tides of negative feedback or complete sentiment reversals, highlighting a sharp polarization between "hype" and "satisfaction" in the final stretch of the year. From the aggregate leaderboard to the specific battlegrounds of r/TheOCS and r/CanadianCannabisLPs, here is the definitive breakdown of who won December.

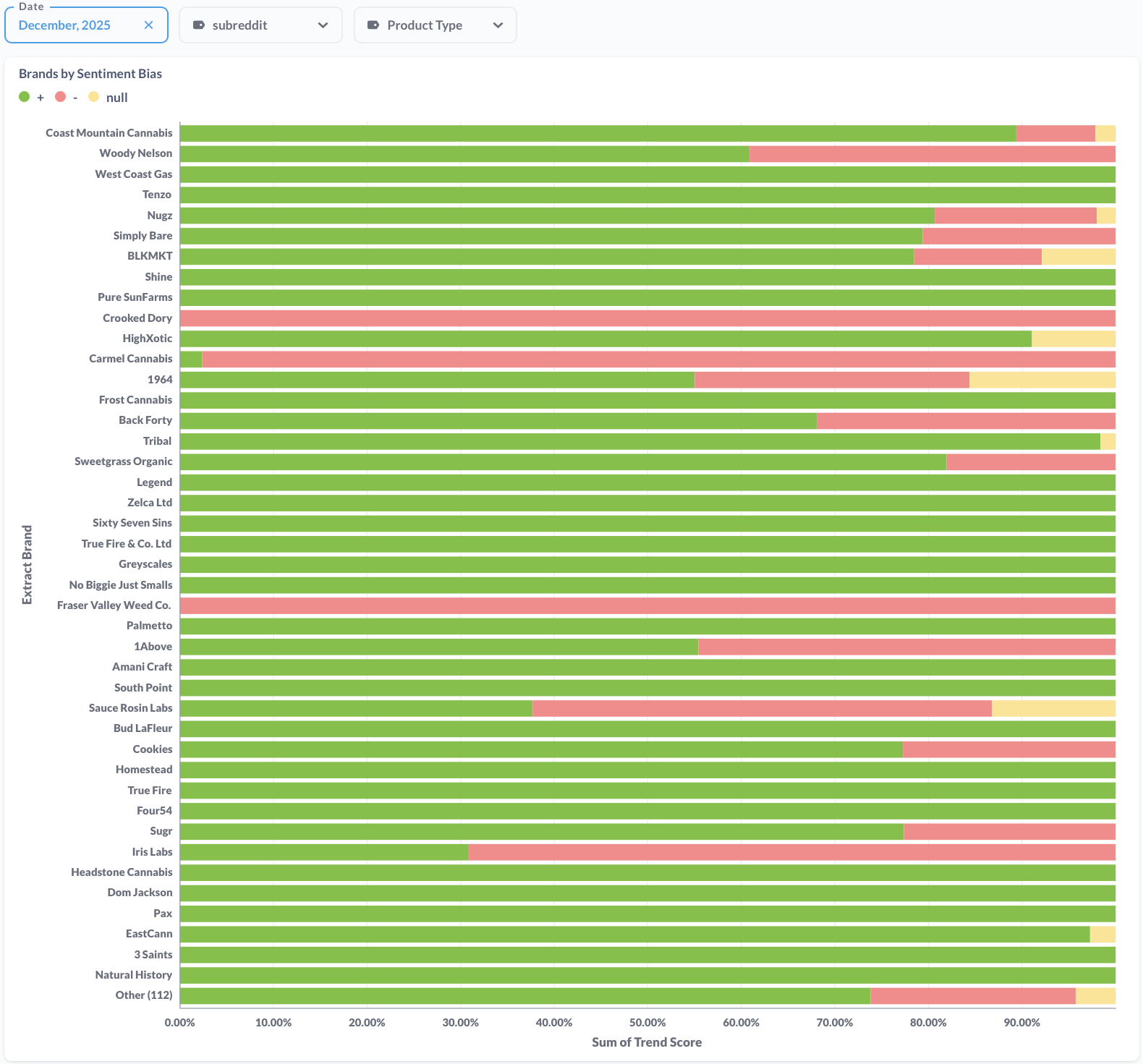

ALL PRODUCT TYPES - December 2025

The following data represents the aggregate activity across all product categories.

Woody Nelson has reclaimed the #1 spot in total engagement with a massive 6,932 Trend Score—more than doubling their November volume. However, the sentiment remains highly polarizing at 6.1. The most notable insight this month is the shift in "Sentiment Moats." While Tenzo and West Coast Gas achieved absolute perfection with 10.0 scores, former leaders like Simply Bare saw their sentiment slip to 7.9, reflecting a more critical eye from the community as the year came to a close.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Woody Nelson | 6,932 | 4,220 | 2,712 | 6.1 |

| 2 | Coast Mountain Cannabis | 4,740 | 4,329 | 410 | 9.1 |

| 3 | Nugz | 3,948 | 3,250 | 697 | 8.2 |

| 4 | Simply Bare | 3,646 | 2,894 | 752 | 7.9 |

| 5 | West Coast Gas | 3,558 | 3,558 | 0 | 10.0 |

| 6 | Tenzo | 3,467 | 3,467 | 0 | 10.0 |

| 7 | BLKMKT | 3,397 | 2,894 | 503 | 8.5 |

| 8 | 1964 | 2,472 | 1,612 | 860 | 6.5 |

| 9 | Back Forty | 2,203 | 1,501 | 702 | 6.8 |

| 10 | Pure SunFarms | 1,922 | 1,922 | 0 | 10.0 |

| 11 | Crooked Dory | 1,779 | 0 | 1,779 | 0.0 |

| 12 | HighXotic | 1,755 | 1,755 | 0 | 10.0 |

| 13 | Carmel Cannabis | 1,667 | 39 | 1,628 | 0.2 |

| 14 | Sweetgrass Organic | 1,608 | 1,317 | 290 | 8.2 |

| 15 | Frost Cannabis | 1,603 | 1,603 | 0 | 10.0 |

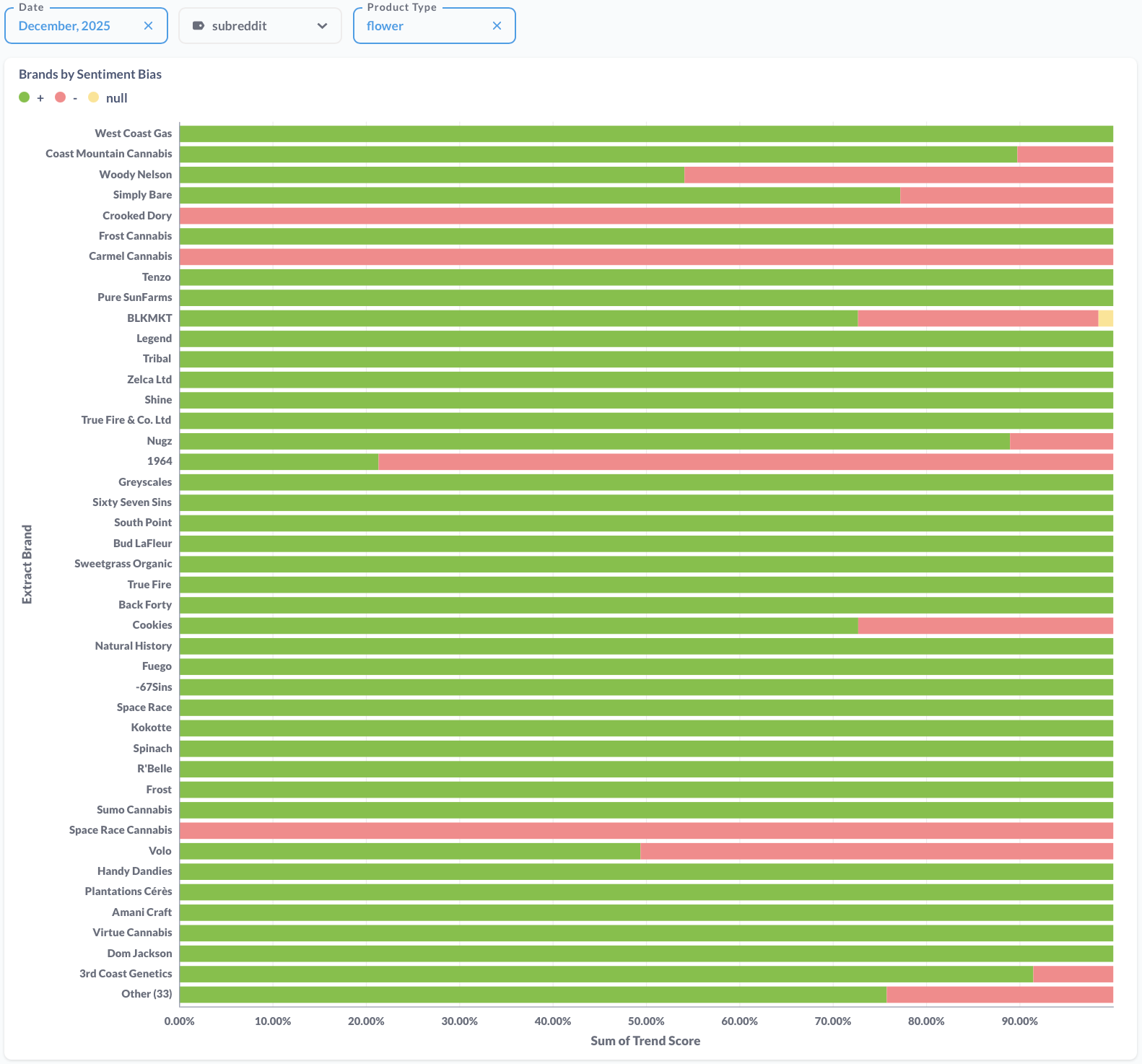

FLOWER - December 2025

The top Flower brands for the month.

The Flower category is currently a battleground of consistency. Woody Nelson holds the top spot for volume but struggles with a 5.4 sentiment score, reflecting widespread community debate over recent batches of staple offerings. Meanwhile, West Coast Gas has emerged as the definitive "safe bet" for flower enthusiasts, securing the #2 spot with a flawless 10.0 sentiment score. Crooked Dory and Carmel Cannabis both appear in the top 10 for volume, but with scores of 0.0, indicating their presence is driven entirely by consumer warnings.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Woody Nelson | 5,259 | 2,844 | 2,415 | 5.4 |

| 2 | West Coast Gas | 3,558 | 3,558 | 0 | 10.0 |

| 3 | Simply Bare | 3,295 | 2,544 | 752 | 7.7 |

| 4 | Coast Mountain Cannabis | 3,179 | 2,852 | 327 | 9.0 |

| 5 | BLKMKT | 1,924 | 1,420 | 503 | 7.4 |

| 6 | Crooked Dory | 1,779 | 0 | 1,779 | 0.0 |

| 7 | Frost Cannabis | 1,603 | 1,603 | 0 | 10.0 |

| 8 | Carmel Cannabis | 1,555 | 0 | 1,555 | 0.0 |

| 9 | Tenzo | 1,540 | 1,540 | 0 | 10.0 |

| 10 | Pure SunFarms | 1,449 | 1,449 | 0 | 10.0 |

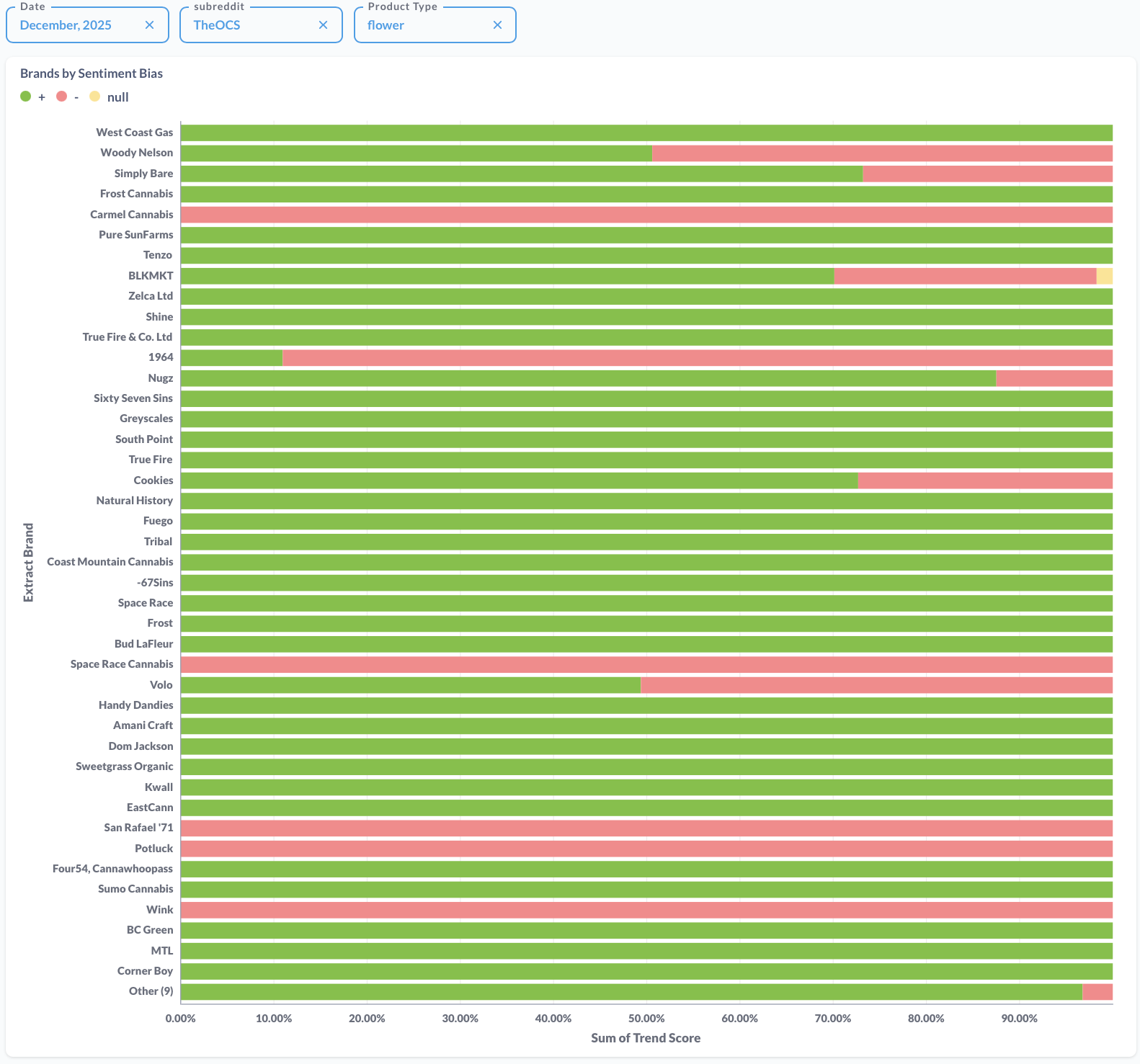

r/THEOCS FLOWER - December 2025

Top Flower brands discussed specifically on r/TheOCS.

On Canada’s largest cannabis subreddit, the story remains one of polarized engagement. Woody Nelson is the most discussed brand by a significant margin, but nearly half of that discussion is driven by critical feedback. West Coast Gas and Frost Cannabis represent the community's high-satisfaction pillars this month, maintaining perfect scores amidst the holiday noise. Notably, 1964 has seen a sharp decline in sentiment on this platform, dropping to a 1.1 score as users flag batch-specific disappointments.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Woody Nelson | 4,888 | 2,473 | 2,415 | 5.1 |

| 2 | West Coast Gas | 3,558 | 3,558 | 0 | 10.0 |

| 3 | Simply Bare | 2,806 | 2,055 | 752 | 7.3 |

| 4 | BLKMKT | 1,758 | 1,255 | 503 | 7.1 |

| 5 | Frost Cannabis | 1,603 | 1,603 | 0 | 10.0 |

| 6 | Carmel Cannabis | 1,555 | 0 | 1,555 | 0.0 |

| 7 | Pure SunFarms | 1,449 | 1,449 | 0 | 10.0 |

| 8 | Tenzo | 1,361 | 1,361 | 0 | 10.0 |

| 9 | Zelca Ltd | 1,130 | 1,130 | 0 | 10.0 |

| 10 | 1964 | 965 | 106 | 860 | 1.1 |

r/CANADIANCANNABISLPS FLOWER - December 2025

Top Flower brands discussed on the medical-focused r/CanadianCannabisLPs.

The medical community continues to operate on a different wavelength than the recreational market. Coast Mountain Cannabis remains the undisputed king of the medical-focused audience with flawless feedback. However, the #2 spot is now held by Crooked Dory, which has generated massive volume but exclusively negative sentiment, signaling a serious disconnect with the patient community regarding recent batch quality.

| Rank | Brand | Total Trend Score | (+) Positive Bias | (-) Negative Bias | Sentiment Score (0-10) |

| 1 | Coast Mountain Cannabis | 2,263 | 2,263 | 0 | 10.0 |

| 2 | Crooked Dory | 1,779 | 0 | 1,779 | 0.0 |

| 3 | Back Forty | 535 | 535 | 0 | 10.0 |

| 4 | Spinach | 415 | 415 | 0 | 10.0 |

| 5 | Sweetgrass Organic | 385 | 385 | 0 | 10.0 |

| 6 | Simply Bare | 384 | 384 | 0 | 10.0 |

| 7 | Virtue Cannabis | 280 | 280 | 0 | 10.0 |

| 8 | 3rd Coast Genetics | 267 | 267 | 0 | 10.0 |

| 9 | Headstone Cannabis | 216 | 216 | 0 | 10.0 |

| 10 | Sumo Cannabis | 171 | 171 | 0 | 10.0 |

The Margin for Error is Gone

The lesson from December 2025 is that volume is no longer a proxy for success; it is simply a measure of visibility. As we saw with the massive trend scores of Woody Nelson and Crooked Dory, being "the talk of the town" on Reddit can often be a liability if the sentiment is overwhelmingly critical. The community is faster than ever at identifying and amplifying inconsistencies, making the holiday season a high-risk period for even the most beloved producers.

Consistency has emerged as the most valuable asset in the Canadian market. Brands like West Coast Gas, Tenzo, and Frost Cannabis have finished the year with a powerful "sentiment moat," proving that they can navigate high-volume periods without sacrificing product integrity. For retailers and consumers alike, these brands represent the only reliable "currency" in an increasingly volatile marketplace.

As we turn the page to 2026, the focus for LPs must move beyond mere attention and toward the restoration of trust. The "Sentiment Bias" data from December shows a market that is ready to reward quality with massive engagement, but equally prepared to punish mediocrity with viral negativity. The margin for error is effectively gone.

Want deeper insights? Stay tuned to the BudTrendz blog for weekly updates, or contact us to see how your specific brand is trending in real-time.