Cannabis Reddit Trends: October 2025 Activity, Sentiment, and Community Insights

October 2025 data reveals nuanced shifts across Canadian cannabis subreddits, marked by a partial rebound in engagement and complex sentiment dynamics. Contrary to the sustained declines of summer and early autumn, October demonstrates modest increases in activity for some segments, while negative sentiment moderates in notable product categories like flower. Detailed month-over-month analysis uncovers where engagement, positivity, and controversy are rising or falling, providing deep insights for brands and community managers.

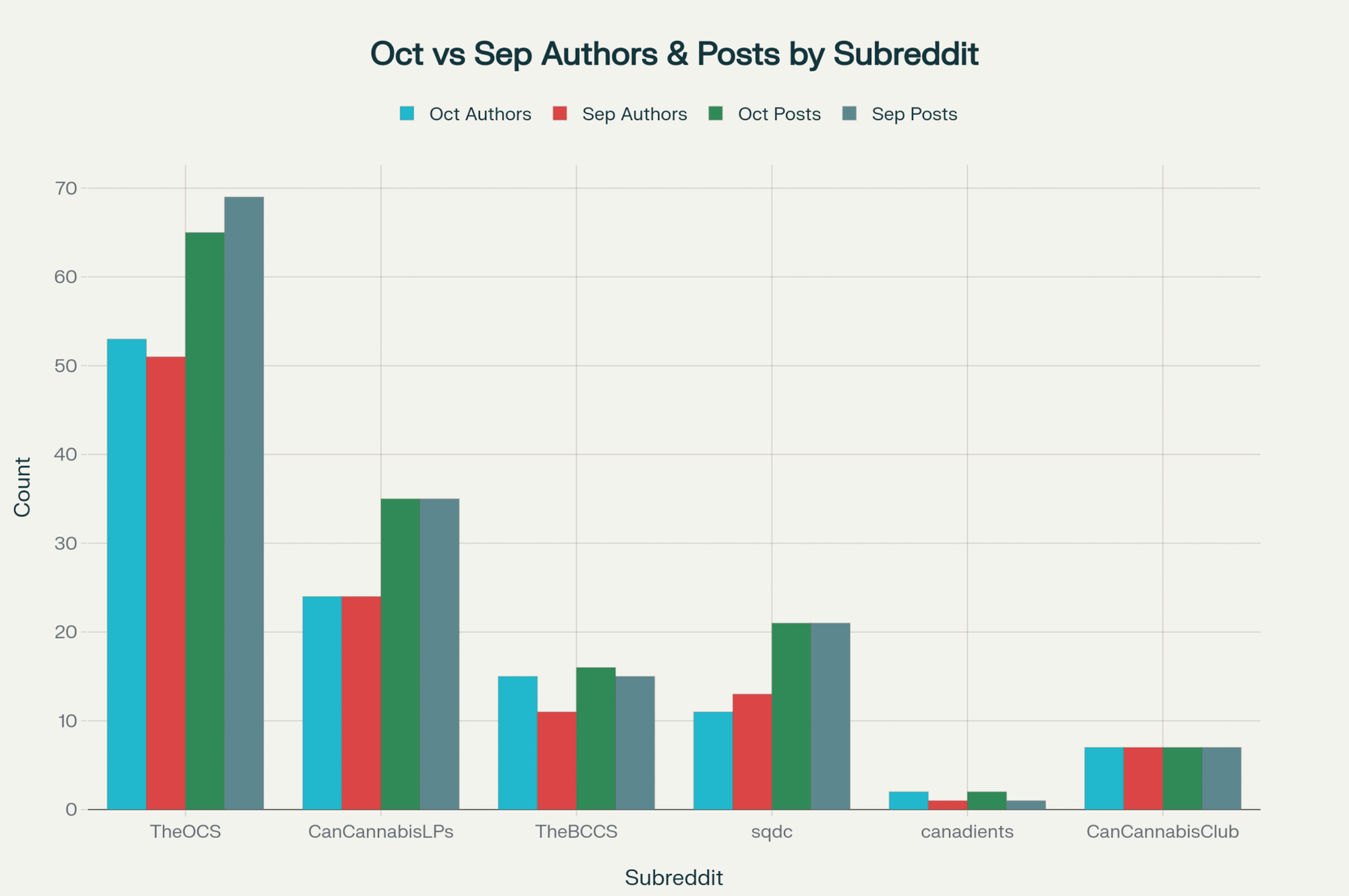

Number of Authors and Posts

In October, the total average number of authors per week held steady or showed slight improvement across several subreddits, contrasting with sharper drops observed in September. The average number of posts per week generally increased, pointing to a tentative revival in participation. Notably, TheOCS sustained its position as the most active subreddit, with 53 average weekly authors (up from 51) and 65 posts per week (up from 59). Meanwhile, CanadianCannabisLPs, TheBCCS, and CanadianCannabisClub all maintained stable author and post volumes, while canadients experienced a rare doubling in participation—though absolute numbers remain very low. The enduring activity in these communities contrasts with the nearly dormant status seen in late summer.

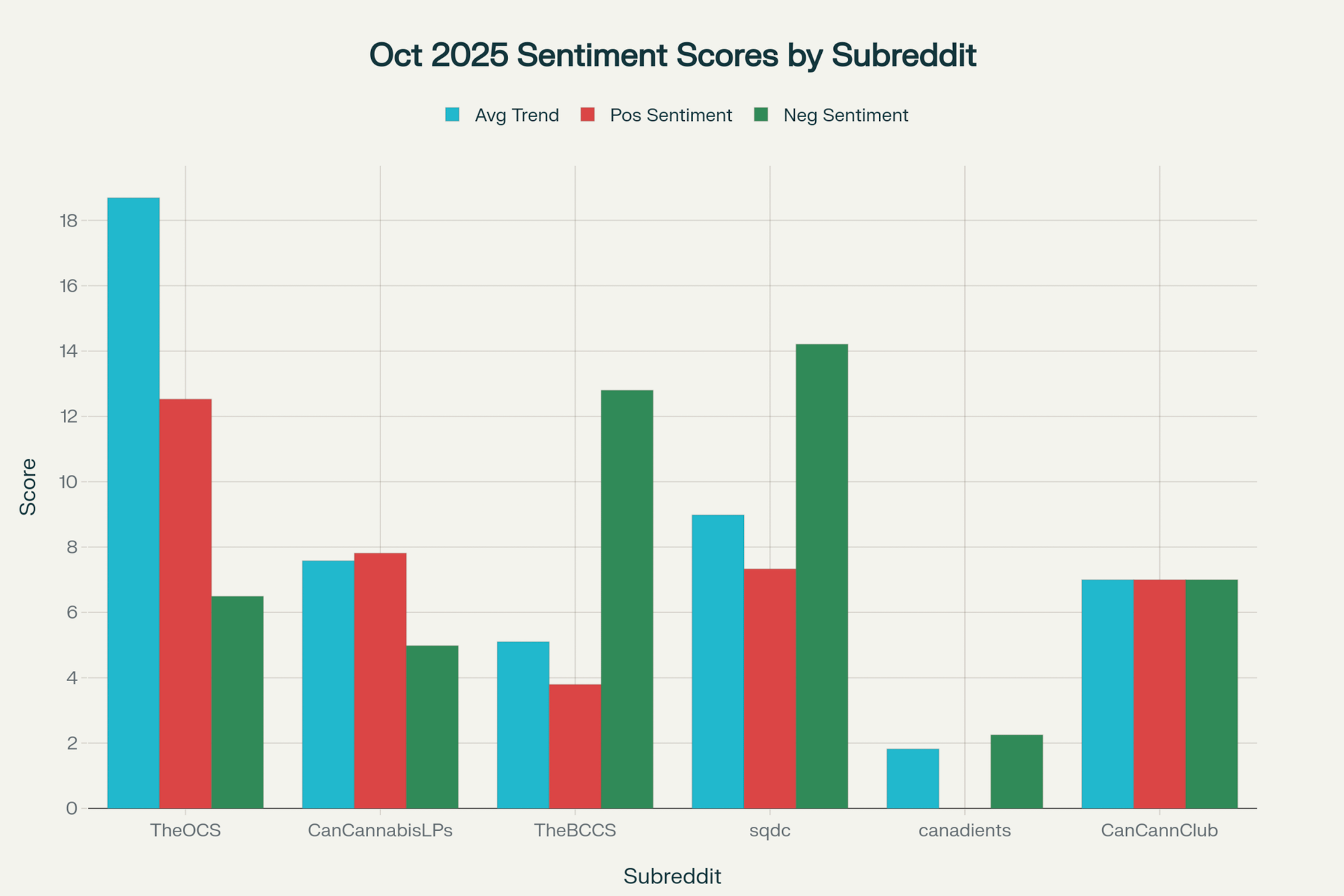

Trend Score and Sentiment Overview

October's trend scores broadly stabilized or recovered, hinting at renewed community interest, especially in TheOCS (18.69) and CanadianCannabisLPs (7.58). Positive sentiment scores rebounded noticeably in TheOCS (12.53, up from 12.94), and held firm or slightly increased in most subreddits. Negative sentiment, however, fell sharply for several subreddits—TheOCS's negative score dropped from 21.98 in September to 6.49 in October. This contraction in negativity suggests that earlier spikes in controversy or dissatisfaction may have been seasonal or reactionary rather than long-term trends. Notably, TheBCCS and sqdc remain communities with high negative sentiment, while CanadianCannabisClub displayed balanced sentiment across positive and negative metrics in October.

General Trends Since Late Summer

Engagement patterns since June show that the major summer declines in post frequency and author activity are now potentially leveling off. October data breaks from the previous consecutive month-on-month decreases, with some subreddits experiencing flat or rising engagement and improved sentiment. However, the rebound is uneven: TheOCS, CanadianCannabisLPs, and CanadianCannabisClub show relative strength, whereas sqdc and TheBCCS experience higher negativity, and canadients, despite small relative gains, remains a niche outlier. This suggests that fatigue or seasonal factors are beginning to give way to renewed interest for certain communities and topics.

Emerging Themes This Month

- Stabilized engagement after months of erosion—with several subreddits showing either flat or increasing author and post numbers.

- Moderation of negative sentiment—particularly striking is the sharp decline in negativity for TheOCS and across flower-related discussions.

- Subtle rebound in flower category discussions, with participation and sentiment figures showing both absolute and percentage increases over September.

Subreddit Spotlight

Here is the Subreddit Spotlight analysis for all six cannabis subreddits tracked in October 2025:

CanadianCannabisClub

- Maintains its reputation as a small but reliably active community, with 7 authors and 7 posts per week, unchanged from September.

- Balanced sentiment profile, with equal positive and negative trend scores, and a stable average trend score.

- Despite its size, this subreddit continues to quietly defy the overall pattern of engagement decline elsewhere.

CanadianCannabisLPs

- Remains a mid-tier community, sustaining 24 authors and 35 posts weekly—identical to September.

- Positive sentiment (7.81) and trend score (7.58) both comparable to last month, hinting at a consistent, optimistic user base.

- Negative sentiment remains subdued (4.98), reflecting relatively harmonious discussions.

TheBCCS

- Experiences a healthy increase to 15 authors and 16 posts per week, a significant jump from September’s 11 authors and 15 posts.

- Trend score climbs to 5.1, while positive sentiment rises to 3.79, though negative sentiment (12.8) warrants attention.

sqdc

- Experiences stable engagement: 11 authors and 21 posts, nearly flat compared to September.

- Negative sentiment persists as the dominant feature (14.21), dwarfing positive sentiment (7.33).

- Trend score of 8.98 signals ongoing, if critical, conversation in the community.

canadients

- Doubled its minimal participation to 2 authors and 2 posts per week, compared to 1 each last month.

- Negative sentiment remains moderate (2.25), with no detected positive sentiment.

- Remains essentially niche but saw rare movement this month.

TheOCS

- Continues to lead by all engagement measures: 53 weekly authors (up 4% MoM), 65 posts (up 10% MoM).

- Trend score holds strong at 18.69; positive sentiment is slightly lower but remains the highest at 12.53.

- Negative sentiment plunges to 6.49 (down 70% MoM), pointing to a return to more positive or balanced discourse.

Subreddit Summary

- TheOCS leads in posts, authors, and trend, but October marks a significant softening of negative sentiment—a notable shift from mid-year discord.

- canadients saw rare upticks but remains inactive in the broader context.

- CanadianCannabisLPs and sqdc are emblematic of middle-tier communities—predictable in volume, but diverging along sentiment lines.

- TheBCCS shows a rare dual spike in both participation and negative sentiment, indicating brewing undercurrents within a previously quiet space.

- CanadianCannabisClub continues to signal contrarian stability in a landscape defined by churn.

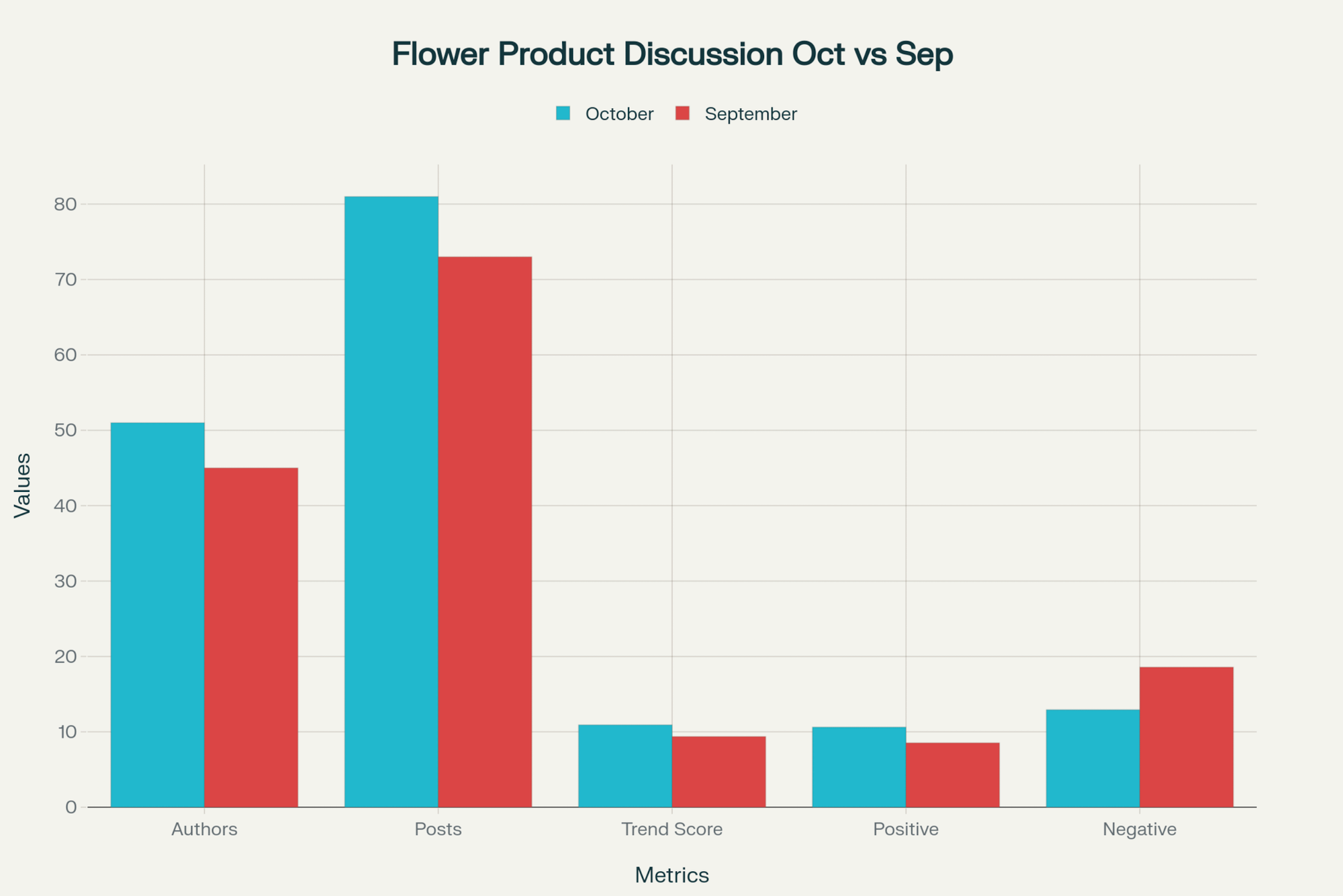

Filter for Flower Products Only

Discussions about cannabis flower products reversed course in October after a particularly negative September. Flower posts and author numbers surged—81 posts per week (vs 73 in September), with authors rising to 51 (from 45). Trend scores also accelerated upward, and both positive sentiment and negative sentiment improved markedly.

Number of Authors and Posts (Flower)

- October brought a robust recovery to flower-focused engagement: posts and authors both increased by over 10%.

- This increase outpaces the overall subreddit population trend, highlighting renewed interest in flower as a discussion driver.

Trend Scores and Sentiment (Flower)

- The average flower-trend score jumped to 10.91, up from 9.38 in September.

- Positive sentiment soared from 8.54 to 10.62, while negative sentiment plummeted from 18.58 to 12.93—a substantial move toward optimism.

- These shifts suggest that negative sentiment was seasonal or related to short-lived pain points and controversies.

Bigger Picture

- The flower product category maintained its dominance for engagement, now showing clear signs of recovery ahead of the broader subreddits.

- The October drop in negativity and improvement in trend and sentiment scores points to stabilization, possibly signaling the end of the summer slump that impacted cannabis discourse across Canada.

- Communities associated with brands or retailers (TheOCS, CanadianCannabisLPs) remain crucial bellwethers, driving the majority of conversation and setting sentiment trajectories for the sector at large.

Key Takeaways

- Engagement rebounded or held steady across all major subreddits in October, breaking several months of decline.

- Negative sentiment dropped sharply in the most active subreddits and in flower discussion posts.

- TheOCS remains the primary conversation leader, but now with less controversy and more balanced dialogue.

- CanadianCannabisLPs and sqdc continue as stable, mid-tier communities with divergent sentiment profiles.

- Overall flower discussion revived, reversing course from the previous month’s drastic downturn.

Conclusion

The October 2025 cannabis subreddit landscape demonstrates resilience, with clear signs of stabilization and renewed optimism across most communities and especially in the flower product segment. As negative sentiment retreats and participation ticks upwards, community managers and industry observers have early indications of a more positive, engaging season ahead.