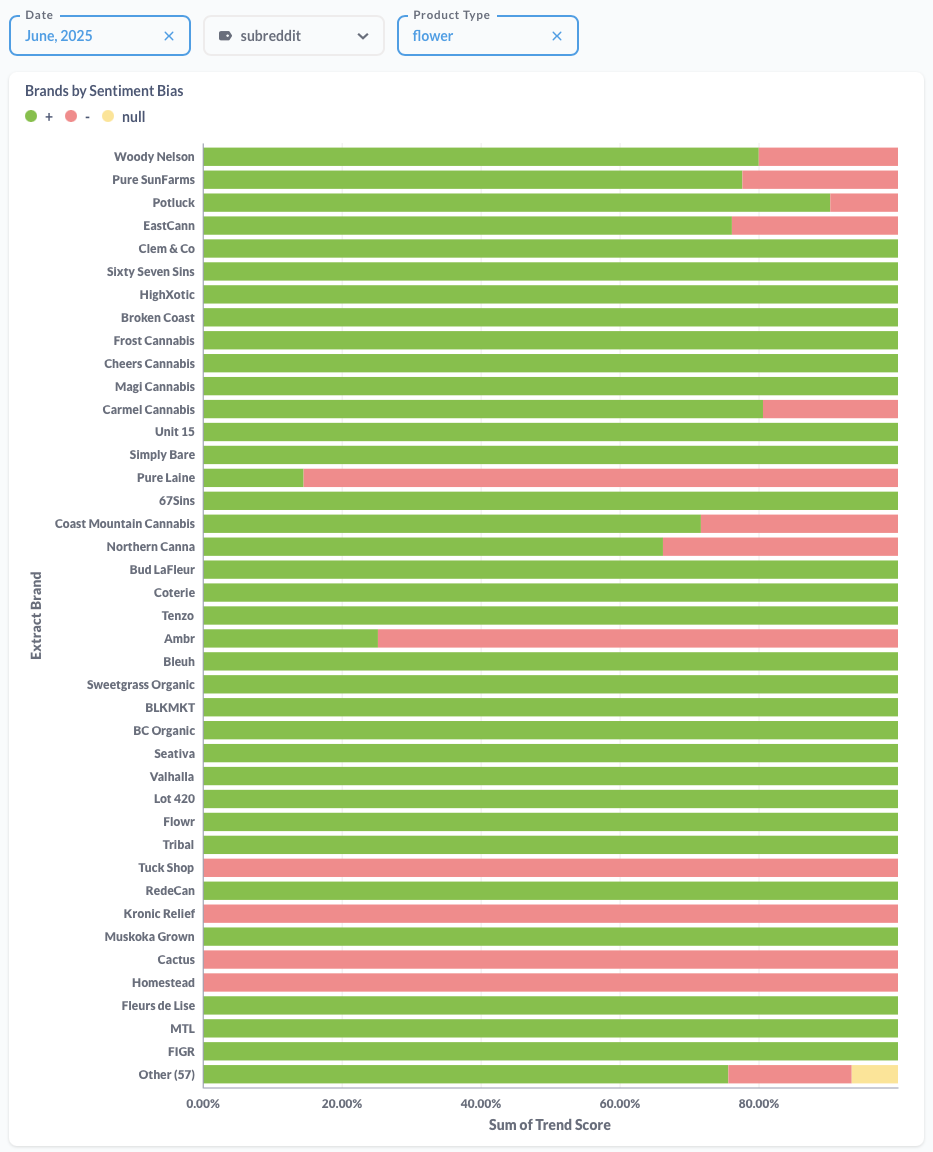

Canadian Cannabis Brands by Sentiment – June 2025 (Flower)

Real Reddit Reviews Across Canada

Each month, BudTrendz analyzes sentiment and trend score data from six of the most active Canadian cannabis subreddits to determine which brands made the biggest impact — and how the community felt about them.

This month’s results reflect a more active, more opinionated consumer base — with more brands, bigger swings, and some surprising reversals.

📊 How Many Brands Made the Chart?

In June, 84 distinct flower brands made the chart — more than double May’s 39. This expansion signals wider engagement, as consumers increasingly explore lesser-known options beyond just the top names.

🏆 Top 5 Brands by Positive Sentiment

(Ranked by total positive trend score)

- Woody Nelson – Maintains the top spot with nearly 3,750 in positive score

- Pure Sunfarms – Back in the top tier after May’s slump

- Potluck – Holding strong as a consistently praised mid-tier brand

- EastCann – Positive surge despite lingering mixed sentiment

- Clem & Co – New favorite gaining fast thanks to standout pre-rolls and flower

📌 Notable Rise: EastCann’s positive trend score (1,806) vastly outweighed its negative (567), reflecting a major turnaround from May.

🚫 Brands with Notable Negative Sentiment

Some brands struggled to maintain reputation, either from quality concerns, inconsistent batches, or higher visibility leading to scrutiny:

- Woody Nelson – Despite being #1 overall, it also had the highest negative trend score (937), a sign of increasing pressure at the top

- Pure Laine – Overwhelmingly negative sentiment

- EastCann, Pure Sunfarms – Still drawing criticism even while rebounding

- Tuck Shop, Cactus, Kronic Relief – Negative-dominant profiles for the second month in a row

- Homestead – Again on the wrong side of sentiment

🧠 Takeaway: More visibility means more feedback — good or bad.

🥇 Who Got the Most Overall Attention?

When combining all sentiment categories (positive, neutral, and negative), these brands captured the most attention:

- 🥇 Woody Nelson – Still the highest overall trend score and largest brand presence

- 🥈 Pure Sunfarms – A controversial comeback, back in the spotlight

- 🥉 Potluck – Proving it’s more than just value pricing

- 💥 EastCann – Sentiment swings, but still dominates discussion

- 📈 Clem & Co – Positive word-of-mouth pushing them into the spotlight fast

Key Changes from May to June

📈 Winners:

- Clem & Co – Climbed rapidly into the top 5 with positive buzz

- EastCann – Major positive sentiment rebound

- Potluck – Retains relevance with balanced sentiment

- Woody Nelson – Retains dominance despite mixed feedback

📉 Losers:

- 1964 – Former top brand dropped significantly in total score

- Tribal – Down from May, barely breaking into the top 30

- Simply Bare – Lowered position compared to previous months

- BLKMKT – Still getting talked about, but less enthusiastically

🔎 Woody Nelson and EastCann appearing in both top positive and top negative categories reflect their high visibility and polarizing perception.

🧠 Final Takeaways

1. Market Engagement Exploding:

With more brands being reviewed, Reddit users are venturing beyond the usual suspects and spotlighting new players.

2. Visibility = Vulnerability:

Popular brands like Woody Nelson and Pure Sunfarms face more intense scrutiny. Even beloved brands aren’t immune to backlash.

3. Comebacks and Consistency:

EastCann, Pure Sunfarms, and Potluck show that brands can bounce back from poor sentiment — and consistency pays off for names like Clem & Co and Cheers Cannabis.

4. Craft Still Reigns:

Even with more players, the best sentiment continues to cluster around craft and premium flower — a trend that shows no signs of slowing.

📈 Want to explore the data yourself?

You can filter by subreddit and time period in our Live Brand Sentiment Dashboard here:

🔗 https://budtrendz.com/blog/canadian-cannabis-brands-by-sentiment-bias/

Stay tuned for more insights each week as we track the evolving Canadian cannabis landscape through the lens of Reddit's most engaged consumers.