2025 Cannabis Industry Leaders: Brands & Products

I. Introduction

The 2025 cannabis landscape marks a significant departure from the feverish "land grab" of the previous seven years. We have moved past the era of rapid, unchecked expansion into a period of market plateau and consolidation. As the dust settles, the industry is no longer defined by who can grow the most, but by who can maintain the highest quality in a somewhat stagnant space. In this environment, consumer loyalty is no longer guaranteed; instead, the community has become a group of "gem hunters," looking for the exceptional cultivars and consistent performers that stand out from the noise.

To find these gems, we use the Trend Score. This metric allows us to see past the marketing budgets and identify which brands are actually capturing the collective consciousness of the community through momentum and sustained engagement.

II. Methodology & Metrics

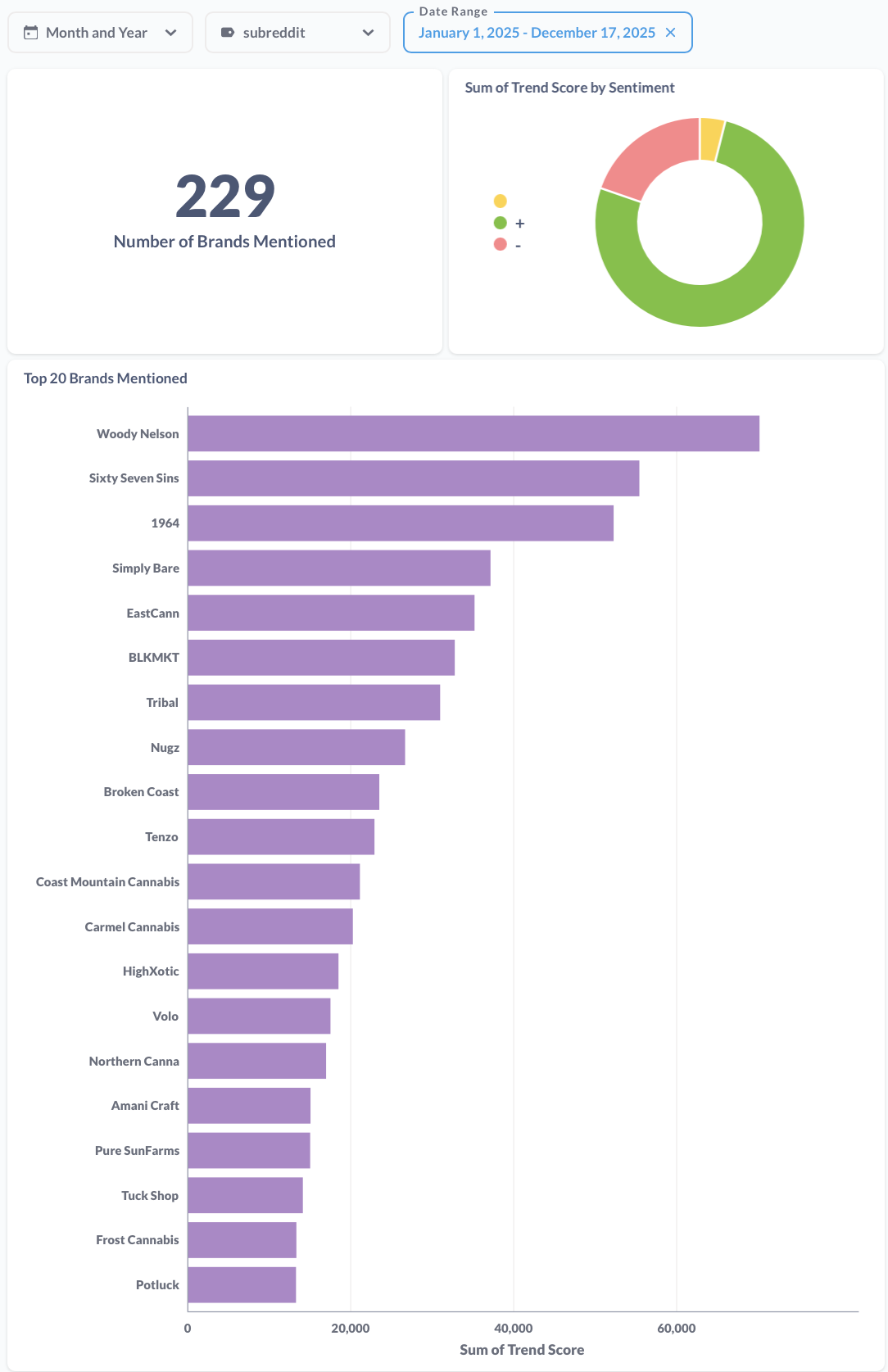

To determine our winners, we tracked 229 unique brands throughout 2025. Our rankings are built on several key performance indicators:

- Trend Score: A weighted metric that measures a brand's overall momentum by combining how often they are mentioned with the level of engagement those mentions receive.

- Sentiment Scale: An analysis of user language to categorize the "vibe" of the conversation into Positive (+), Negative (-), and Neutral sentiment.

- Post Count: The raw volume of unique discussions or posts dedicated to a specific brand.

III. Top Brands of 2025

The Heavy Hitters (By Trend Score)

These five brands didn't just survive the 2025 plateau—they thrived by consistently delivering what the community demanded.

- Woody Nelson (Trend Score: ~70,000) The undisputed heavyweight of the year. Woody Nelson maintained a massive lead, nearly doubling the engagement of many competitors, solidifying their spot as the primary subject of community discussion.

- Sixty Seven Sins (Trend Score: ~55,000) A powerhouse that secured the #2 spot by consistently launching products that kept the momentum high throughout the year.

- 1964 (Trend Score: ~52,000) A masterclass in legacy appeal, 1964 remains a community staple thanks to its heavy-hitting traditional offerings. Cultivars like Comatose Kush and Bubba Kush have become the gold standard for those seeking potent, reliable "old school" effects.

- Simply Bare (Trend Score: ~37,000) As the leader in the organic, living-soil space, Simply Bare continues to impress "gem hunters" with unique terpene profiles. This year, their Fruit Loopz (with a 'z') has been a standout, praised for its mouth-watering fruit and berry notes that differentiate it from the standard market fare.

- EastCann (Trend Score: ~35,000) Rounding out the top five, EastCann has solidified its reputation for consistency, proving that in a consolidated market, being reliable is a winning strategy.

Sentiment Spotlight

While total engagement is high, these brands led specifically in Positive Sentiment Score, indicating that the community isn't just talking about them—they are actively celebrating them:

- Woody Nelson (~54k Positive Score)

- Sixty Seven Sins (~48k Positive Score)

- 1964 (~47k Positive Score)

- Simply Bare (~33k Positive Score)

- EastCann (~32k Positive Score)

IV. Top Products of 2025: The Flower Category

The "Gold Standard" (Top 5 Flower by Trend Score)

These products were the primary drivers of discussion in 2025. They represent the peak of market momentum, combining high-volume mentions with intense community interest.

- Country Club by Woody Nelson (Trend Score: ~23,735) Dominating the flower category, Country Club was the clear standout of the year. As a rotating strain offering, the specific cultivar in the bag may change, but the quality remains consistent. It is important to note that Woody Nelson operates as a processor, not a grower; they curate and feature high-quality flower from a wide variety of skilled growers, making Country Club a "best of" showcase for the industry.

- Fishy Finger by Sixty Seven Sins (Trend Score: ~9,337) A strong runner-up that captured the community's curiosity with its unique branding and the high-velocity engagement typical of the Sixty Seven Sins label.

- LA Kush by 1964 (Trend Score: ~8,525) A testament to the "traditional" market's staying power, LA Kushremains a staple for those seeking classic, heavy-hitting profiles and heritage quality.

- Stinky Pinky by 1964 (Trend Score: ~7,417) Further solidifying 1964's dominance in the top five, Stinky Pinkytrended heavily as a reliable, high-potency favorite for kush lovers.

- Gas Face by Sixty Seven Sins (Trend Score: ~7,287) Rounding out the top five, Gas Face kept the momentum high for Sixty Seven Sins, proving that "gas" profiles remain a top priority for 2025 "gem hunters".

The Fan Favorites (Top 5 Flower by Sentiment Scale)

To ensure these rankings reflect a true community consensus, we have omitted any products with fewer than three unique reviewers. These "Fan Favorites" represent the highest-rated flower of the year, where quality and satisfaction scores were consistently exceptional across multiple users.

- Platinum Pink Kush by West Coast Gas

- Sentiment Score: 9.56/10

- Trend Score: ~2,904

- Reviewers: 5

- A masterclass in the Pink Kush lineage, this offering set the standard for quality in its category this year.

- Apple Toffee by Simply Bare

- Sentiment Score: 9.55/10

- Trend Score: ~2,191

- Reviewers: 4

- Continuing Simply Bare’s streak of high-quality organic offerings, Apple Toffee is a critical darling praised for its flavor and smooth experience.

- Espresso Gelato by Tenzo

- Sentiment Score: 9.51/10

- Trend Score: ~2,573

- Reviewers: 4

- Tenzo’s Espresso Gelato was highly celebrated for its unique profile and consistent bag appeal.

- Platinum Pavé by Broken Coast

- Sentiment Score: 9.48/10

- Trend Score: ~2,006

- Reviewers: 5

- A high-performing "gem" that restored faith in the legacy of the Broken Coast brand for many enthusiasts.

- Vanilla Frosting by Coast Mountain Cannabis

- Sentiment Score: 9.42/10

- Trend Score: ~2,306

- Reviewers: 4

- A terpene-rich favorite that rounded out the top five with high praise for its cure and aromatic complexity.

V. Specialized Categories

Concentrate of the Year

- Winner: Live Crm Brlé Grease Bucket by Sauce Rosin Labs (Rosin) With the highest trend score among non-vape extracts, the Grease Bucket Rosin was the "go-to" for dabbing enthusiasts in 2025, celebrated for its preservation of live terpenes and clean finish.

Vape Pen of the Year

- Winner: LA Kush 510 Cart by 1964 Proving that their flower success translates perfectly to hardware, 1964's LA Kush 510 cartridge was the most discussed and sought-after vape of the year.

Top Flower Offering

- Winner: Country Club by Woody Nelson As the overall leader in flower trend scores, Country Club takes the title for the top consistent flower offering that defined the premium market this year.

VI. Key Findings

- The Processor Advantage: Woody Nelson’s position as the #1 brand by Trend Score (~70,000) and the success of their Country Club offering (~23,735 Trend Score) demonstrates that in a consolidated market, the ability to curate and process high-quality flower from multiple growers is a winning strategy.

- The Return to Heritage: Despite the plateau in market expansion, traditional profiles remain the backbone of consumer demand. 1964’s dominance in both the Flower and Vape categories with LA Kush and Stinky Pinkyshows that "old school" reliability is a primary driver of sustained engagement.

- Boutique Satisfaction: While the largest brands lead in volume, smaller "boutique" players like Frost Cannabis and West Coast Gas achieved the highest sentiment scores (9.56+), suggesting that "gem hunters" are increasingly finding their top-tier experiences within niche, craft-focused catalogues.

- Concentrate Specialization: Sauce Rosin Labs carved out a significant lead in the artisanal concentrate space, proving that there is a dedicated and growing audience for high-end, solventless extracts like their Grease Bucket rosin.

VII. Conclusion

As we close out 2025, the cannabis industry has entered a "quality-first" era. The rapid, unchecked expansion of previous years has given way to a more discerning and stable market. Success in this environment is no longer just about scale; it is about capturing the community's imagination through consistency, heritage, and unique terpene profiles.

The brands and products highlighted in this report—from the dominant curation of Woody Nelson to the artisanal precision of Frost Cannabis—represent the "gems" that defined the year. As we look toward 2026, the trend is clear: the community will continue to reward transparency, quality, and the brands that can reliably deliver a premium experience in a crowded, plateaued field.